Top 20 Passive Income Ideas for Young Adults

Want to earn money while you sleep? Passive income is a great way to boost your financial security with minimal ongoing effort. As a young adult,

Calculating your mortgage payments involves several factors, but with Capitacritique Mortgage Calculator, you can quickly and easily solve this math problem.

Home Price: Start by entering the price of the home you’re considering buying or the current value of your home if you’re refinancing.

Down Payment: In the “Down payment” section, input the amount of your down payment if you’re buying a home, or the amount of equity you have if you’re refinancing. Your down payment is the upfront cash you pay, while home equity is the value of the home minus what you owe. You can enter either a dollar amount or the percentage of the purchase price you’re putting down.

Length of Loan: Choose the term of your loan, typically 30 years but could be 20, 15, or 10 years. Our calculator adjusts the repayment schedule accordingly.

Interest Rate: Enter the interest rate you expect to pay. Our calculator defaults to the current average rate, but you can adjust it as needed. Keep in mind that your rate may vary depending on whether you’re buying or refinancing.

As you input these details, the calculator will generate a new amount for principal and interest to the right. Additionally, Capitacritique calculator estimates property taxes, homeowners insurance, and homeowners association fees. While you’re shopping for a loan, you can edit these amounts or ignore them as they might be rolled into your escrow payment. However, they won’t affect your principal and interest as you explore your options.

Using Capitacritique Mortgage Calculator simplifies the complex process of calculating your mortgage payments, allowing you to make informed decisions about your home financing.

Understanding the components of your mortgage payment is essential for managing your finances effectively. Here’s a breakdown of what comprises your mortgage payment:

Principal: This is the initial amount you borrowed from the lender to purchase your home. Each month, a portion of your mortgage payment goes toward paying down the principal balance.

Interest: The lender charges you interest as the cost of borrowing the money. Interest rates are expressed as an annual percentage and are based on various factors, including your credit score, loan term, and prevailing market rates. A significant portion of your monthly mortgage payment goes toward paying off the interest.

Property Taxes: Local authorities levy an annual tax on your property based on its assessed value. If you have an escrow account set up with your lender, a portion of your monthly mortgage payment goes toward covering your property taxes. The lender then pays the property tax bill directly to the local tax collector when it’s due.

Homeowners Insurance: Homeowners insurance protects you financially against damage or losses to your home and belongings from hazards such as fire, storms, theft, and liability claims. Similar to property taxes, if you have an escrow account, a portion of your monthly mortgage payment goes toward paying your homeowners insurance premium. The lender or servicer then pays the insurance premium on your behalf when it’s due.

Mortgage Insurance: If your down payment is less than 20% of the home’s purchase price, you’re typically required to pay for mortgage insurance. Mortgage insurance protects the lender in case you default on the loan. The cost of mortgage insurance is added to your monthly mortgage payment until you reach a certain level of equity in your home.

Understanding these components of your mortgage payment can help you budget effectively and make informed decisions about your homeownership expenses.

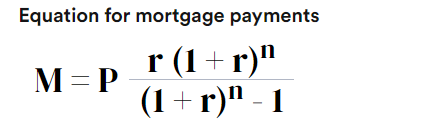

Understanding the symbols and formulas used in mortgage calculations can help you make informed decisions about your home financing. Here’s a breakdown of the key symbols and their meanings:

By understanding these symbols and formulas, you can estimate your monthly mortgage payment and determine how much house you can afford. However, using a Mortgage Calculator can simplify this process for you, eliminating the need for manual calculations. Additionally, it’s wise to shop around and compare offers from multiple lenders to ensure you secure the best possible deal for your mortgage.

When setting your housing budget, calculating your monthly house payment is essential, as it often constitutes your largest recurring expense. Capitacritique Mortgage Calculator offers a convenient way to estimate your mortgage payment as you navigate purchase loans or refinancing options. By adjusting the details in the calculator, you can explore various scenarios and make informed decisions regarding:

Loan Length: Determine the loan term that suits your financial situation. A 30-year fixed-rate mortgage typically offers lower monthly payments, making it suitable for those with fixed budgets. However, you’ll pay more interest over the loan’s duration. On the other hand, a 15-year fixed-rate mortgage reduces the total interest paid but requires higher monthly payments.

Adjustable-Rate Mortgage (ARM): Assess whether an ARM is a viable option for you. Initial rates for ARMs are often lower than those for fixed-rate mortgages. For instance, a 5/6 ARM, with a fixed rate for five years before adjusting every six months, might be suitable if you plan to relocate within a few years. However, be cautious about potential increases in your monthly payment when the introductory rate expires.

Affordability: Use the Mortgage Calculator to gauge whether you’re spending within your means. It provides an overview of your expected monthly payment, inclusive of taxes and insurance.

Down Payment: Determine how much to put down. While a 20% down payment is considered standard, it’s not obligatory. Many borrowers opt for down payments as low as 3%.

By utilizing Capitacritique Mortgage Calculator and considering these factors, you can better understand your housing expenses and make sound financial decisions tailored to your needs and preferences.

If you’re uncertain about the portion of your income that should be allocated towards housing expenses, consider adhering to the 28/36 percent rule, a widely recognized guideline among financial advisors. According to this rule:

Here’s an illustration of how this rule works:

Let’s say Joe earns $60,000 annually, equating to a gross monthly income of $5,000. Applying the 28 percent rule, Joe’s total monthly mortgage payment (Principal, Interest, Taxes, and Insurance – PITI) should not exceed $1,400.

Therefore, with a maximum monthly mortgage payment of $1,400, Joe’s loan amount would approximate $253,379. Although some loans permit a debt-to-income (DTI) ratio of up to 50 percent, committing such a substantial portion of income to debt may limit flexibility in covering other essential expenses, such as retirement savings, emergency funds, and discretionary spending.

It’s important to recognize that lenders typically preapprove loans without factoring in these additional expenses. Hence, it’s crucial to assess your housing affordability holistically, considering your entire financial picture.

Avoid overextending yourself by opting for a 30-year home loan that exceeds your budgetary limits, regardless of the lender’s willingness to extend credit. Capitacritique “How Much House Can I Afford?” calculator offers valuable insights to help you navigate through these financial considerations and make informed decisions tailored to your financial circumstances.

If the monthly payment calculated by our tool seems a bit beyond your comfort zone, there are strategies you can employ to mitigate the impact. Consider adjusting some of these variables:

Choose a Longer Loan Term: Opting for a longer loan term will result in a lower monthly payment. However, it’s important to note that this approach means paying more interest over the life of the loan.

Spend Less on the Home: Borrowing less money for the purchase translates to a smaller monthly mortgage payment. This might involve considering less expensive properties or increasing your down payment.

Avoid Private Mortgage Insurance (PMI): Aim for a down payment of at least 20 percent of the home’s purchase price, as this exempts you from the requirement of private mortgage insurance. Alternatively, if you’re refinancing, having at least 20 percent equity in your home can also eliminate the need for PMI.

Shop for a Lower Interest Rate: Explore options for securing a lower interest rate on your mortgage. Keep in mind that while some lenders may offer exceptionally low rates, they may require you to pay points upfront as an additional cost.

Make a Larger Down Payment: Increasing the size of your down payment is another effective way to reduce the amount of the loan, resulting in a lower monthly payment and potentially saving on interest over time.

By adjusting these variables, you can tailor your mortgage terms to better align with your financial situation and ensure that your monthly payment remains within a manageable range.

Want to earn money while you sleep? Passive income is a great way to boost your financial security with minimal ongoing effort. As a young adult,

When it comes to purchasing a vehicle, the decision to buy a new or used car is a significant one that affects your finances and

In the ever-shifting landscape of the stock market, understanding the ebb and flow of bull and bear markets is crucial for investors aiming to thrive.

Venturing into the world of investing can be both exciting and daunting for beginners. With a plethora of options and strategies available, it’s crucial to

In the ever-evolving landscape of investing, securing a reliable yield above 5% is a target many investors aim for. With the current financial climate indicating

Navigating the investment landscape requires both innovative and time-tested strategies to diversify and strengthen your portfolio. This article explores a variety of smart investment approaches,

Capitacritique.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Capitacritique does not include information about every financial or credit product or service.