Navigating the investment landscape requires both innovative and time-tested strategies to diversify and strengthen your portfolio. This article explores a variety of smart investment approaches, from the potential of pre-owned vehicles to the dynamic field of cross-border payments, and from leveraging personal industry expertise to balancing passive and active investment methods. Each section provides insights that cater to both novice and experienced investors aiming to optimize their financial growth.

Key Takeaways

- Diversifying your portfolio with pre-owned vehicles can offer stability and growth potential in a fluctuating market.

- Cross-border payments present opportunities for investors to benefit from the rise of global transactions and digital currencies.

- Investing in industries you are familiar with allows you to use your knowledge and network to uncover unique opportunities.

- Balancing passive and active investment strategies can lead to more tailored and potentially rewarding investment outcomes.

- Early investment success hinges on adopting a disciplined approach, building a diverse portfolio, and maintaining a long-term perspective.

Revving Up Your Portfolio with Pre-Owned Vehicles

Understanding the Market for Pre-Owned Vehicles

Dive into the world of pre-owned vehicles and you’ll find a market that’s as diverse as it is dynamic. From budget-conscious families to classic car aficionados, the range of buyers is vast, offering a stable flow of demand. This isn’t just about getting a set of wheels for less; it’s about tapping into a market with a high demand that doesn’t wane, even when the economy hits a bump.

- Lower-income groups and price-conscious buyers often prefer pre-owned vehicles, ensuring a consistent customer base.

- Vintage car enthusiasts provide a niche but lucrative market segment.

- Economic fluctuations can actually increase the attractiveness of pre-owned vehicles as more budget-friendly options.

The beauty of this market lies in its resilience. While new car sales may ebb and flow with economic tides, the pre-owned vehicle market remains buoyant, offering a reliable option for liquidating your investments.

Accessibility of information has never been better, thanks to the digital revolution. Online platforms dish out everything from vehicle histories to price comparisons, making it easier than ever to make informed investment decisions. And let’s not forget the international appeal; your investment could be just what a buyer from another continent is searching for.

Assessing Value and Predicting Growth

When it comes to pre-owned vehicles, the trick is to find that sweet spot where value meets potential growth. It’s not just about the make and model; it’s about understanding the car’s history, its current condition, and the market demand. A car’s value can depreciate faster than you can say ‘zero to sixty’, especially considering that a brand-new car loses about 9% of its value the moment you drive off the lot.

Remember, the goal is to invest in a vehicle that not only retains value but also has the potential to appreciate over time.

Here’s a quick rundown on how to assess a car’s investment potential:

- Check the vehicle’s history report for any red flags.

- Evaluate the car’s condition, including mileage and maintenance records.

- Research market trends for the specific car model.

- Compare prices and conditions of similar vehicles in the market.

By keeping an eye on industry trends and conducting a comprehensive analysis, you can make informed decisions that could lead to significant returns. And hey, who knows? With the right pick, you might just end up with a classic in your garage that’s worth more than its weight in gold.

Navigating Risks and Rewards

Alright, let’s talk turkey about the risks and rewards when it comes to investing in pre-owned vehicles. Understanding your risk tolerance is like knowing how spicy you like your food – it’s crucial to not biting off more than you can chew. You’ve got to align this with the kind of returns you’re aiming for. If you’re the type to buckle up for a wild ride, you might lean towards those high-growth potentials. But if you’re more about that Sunday drive life, then steadier, more predictable investments could be your jam.

- Risk Tolerance: How much market turbulence can you stomach?

- Return Goals: Chasing high returns? Brace for higher risk.

- Market Research: Know your stuff before you put your money down.

- Professional Advice: Sometimes, it’s worth chatting with a pro.

Remember, investing isn’t a one-size-fits-all deal. It’s about finding that sweet spot where your comfort zone and investment goals meet up for a coffee.

And hey, while we’re at it, let’s not forget that the market for pre-owned vehicles isn’t just about intuition. It’s a game of strategy and smarts. You’ll want to keep an eye on long-term market trends and consider the advantage of time, especially if you’re on the younger side of the investor spectrum. With a longer time horizon, you can afford to ride out the bumps and look forward to the potential rewards.

Cross-Border Payments: A World of Opportunity

The Rise of Global Transactions

As the world shrinks thanks to the digital era, the global payments market is booming like never before. It’s not just about sending money from point A to B anymore; it’s about connecting economies, empowering businesses, and fueling growth across borders. The payments market size has grown rapidly in recent years, and it’s showing no signs of slowing down. In fact, it’s projected to leap from $678.42 billion in 2023 to $748.02 billion in 2024, marking a significant compound annual growth.

With the right strategy, cross-border payments can be a goldmine for savvy investors. It’s all about understanding the nuances of international trade and finding the sweet spots in the market.

But it’s not just about the numbers; it’s about the stories behind them. Each transaction is a thread in the fabric of the global economy, weaving together a tapestry of opportunity. Here’s a quick look at some key trends driving this growth:

- The rise of e-commerce and online marketplaces

- Increasing demand for faster, more transparent transactions

- Technological advancements in payment processing

- The growing need for modernization in traditional banking systems

Remember, while the potential is vast, so are the challenges. Navigating currency fluctuations, regulatory landscapes, and fraud risks requires a keen eye and a steady hand. But for those who can manage the risks, the rewards can be substantial.

Choosing the Right Platforms and Currencies

When diving into the world of cross-border payments, picking the right tools and currencies is like choosing the best gear for a deep-sea expedition. You want stuff that’s reliable, efficient, and, most importantly, keeps your treasure safe. Skydo is a shining example, making waves for Indian exporters with its hassle-free, low-cost solutions for receiving international payments. Imagine opening a US virtual account, raising invoices, and tracking your payment status all in one place.

But hey, don’t just take my word for it. Here’s a quick rundown of some top global payment solutions:

- Skydo: Tailored for Indian exporters, offering US virtual accounts.

- PayGlobe: Seamless transactions with real-time currency conversion.

- QuickWire: High-speed transfers with competitive fees.

- ExchangeX: Offers robust security features for peace of mind.

- CryptoPay: For the bold, a gateway to using cryptocurrencies like Bitcoin.

Remember, the currency you choose can make or break your international deals. It’s not just about the exchange rates; it’s also about stability and predictability. > Block out the noise and focus on currencies that have a track record of holding their ground in turbulent waters. < And if you’re feeling adventurous, cryptocurrencies might just be the spice your portfolio needs. Just be sure to buckle up for the ride—it can get bumpy.

Mitigating Risks in International Trade

Diving into the world of international trade can be as thrilling as it is complex. But hey, no high reward without some risk, right? To keep those risks at bay, savvy investors adopt a mix of strategies. Here’s a quick rundown:

- Diversification: Don’t put all your eggs in one basket. Spread your investments across various markets and sectors.

- Research: Stay informed about the political and economic stability of the countries you’re investing in.

- Currency Hedging: Protect yourself against currency fluctuations.

- Legal Know-How: Understand the trade laws and regulations that could affect your investments.

Remember, it’s not just about avoiding risks; it’s about managing them smartly to keep your portfolio thriving in the global market.

And let’s not forget about the importance of timing. Jumping in too early or too late can make a world of difference. So, keep your finger on the pulse of global trends and market signals. After all, in the dance of international trade, timing is everything.

Investing in What You Know Best

Capitalizing on Industry Insights

Ever felt like you’ve got a sixth sense for your industry? That’s your insider knowledge talking, and it’s gold dust when it comes to investments. Leverage your knowledge to spot the winners in a crowd of wannabes. It’s all about playing to your strengths and investing in sectors where you can almost smell the trends before they hit the headlines.

Here’s a quick rundown on how to make those insights work for you:

- Identify industries that mesh with your smarts.

- Keep an eagle eye on industry trends and competitor moves.

- Network like a boss to uncover hidden gems.

Remember, your industry insights are like a secret map to treasure island. Use them wisely, and you could be sailing away with a bounty of investment success.

Don’t just sit on that knowledge; analyze competitors and industry trends to find companies that are leading the pack. They’re the ones with the innovative edge that could pay off big time. And hey, while you’re at it, why not invest a little in your own industry? After all, who knows it better than you?

Networking: Your Secret Investment Weapon

Ever heard the saying, ‘It’s not what you know, but who you know’? Well, in the investment world, it’s a bit of both. Networking is your ace in the hole, a way to tap into a wealth of knowledge and opportunities that might otherwise slip through your fingers.

- Attend industry conferences, join professional organizations, or participate in online communities related to your industry.

- Engage in discussions, share ideas, and build relationships with others in your field.

By connecting with the right crowd, you’re not just building a network; you’re building your net worth.

Remember, investing is a team sport. The more you collaborate with others, the more you learn about emerging trends and hidden gems. So, keep your ear to the ground and your contacts close. Your next big investment could come from a tip at a conference or a chat over coffee with a fellow enthusiast.

Spotting Opportunities Others Miss

Ever felt like you’re always a step behind the latest investment craze? That’s because the best opportunities are often hidden in plain sight. It’s about seeing the potential where others see nothing. Take cryptocurrencies, for instance. They were once the playground of the tech-savvy and the risk-takers. Now, they’re a staple in many savvy investors’ portfolios. But it’s not just about jumping on the bandwagon; it’s about understanding the nuances and finding your edge.

Remember, it’s not the noise that matters, it’s the signal. Cut through the chatter and focus on the data and trends that align with your unique insights.

Here’s a quick checklist to keep you on track:

- Leverage your knowledge: Use your industry insights to spot trends others might miss.

- Network and collaborate: Connect with peers to uncover hidden gems.

- Stay curious: Keep learning and stay open to new ideas.

- Ask questions: Challenge assumptions and dig deeper than the surface.

By keeping these points in mind, you’ll be better equipped to identify those unique investment opportunities that others might have missed. And remember, it’s not about finding a needle in a haystack; it’s about recognizing that the entire haystack might be worth more than it appears.

Balancing the Scales: Passive vs. Active Investing

The Passive Investment Approach: Set It and Forget It?

Ever heard the phrase ‘set it and forget it’ in the investment world? That’s the essence of passive investing. It’s like planting a tree and watching it grow without fussing over it every day. Passive investing is all about long-term growth, with minimal peeping and poking.

By sticking to a passive strategy, you’re betting on the market’s overall efficiency. You’re not trying to beat the game; you’re playing along with it, which can be a less stressful and more cost-effective way to invest.

Here’s the scoop on why passive investing might just be your cup of tea:

- Lower fees: Who doesn’t love saving money?

- Less active trading: Say goodbye to the daily grind of market watching.

- Reduced risk of lagging: Keep pace with the market, rather than trying to sprint ahead.

Remember, while passive investing may sound like a hands-off affair, it’s not about ignoring your investments. It’s crucial to periodically check in on your portfolio to ensure it aligns with your goals, especially as market conditions shift.

Active Investing: Hands-On or Hands-Off?

So you’re thinking about taking the reins of your investment journey, huh? Active investing is all about rolling up your sleeves and diving into the nitty-gritty of the stock market. It’s not just about picking stocks willy-nilly; it’s a game of strategy, research, and sometimes, a bit of gut instinct.

Active investing is like being the captain of your own ship in the vast sea of the market. You’re constantly on the lookout for those mispriced securities that you can snag for a bargain. But remember, with great power comes great responsibility. This approach demands a lot of your time and attention, and let’s not forget the higher costs that come with it.

While passive investing might be the chill, laid-back cousin that’s content with following the market, active investing is the go-getter, always searching for ways to outperform and potentially rake in those higher returns.

Here’s the kicker though: not everyone can consistently beat the market. It’s a tough cookie to crack, and it takes a savvy investor to do it over the long haul. So, before you decide to go full throttle with active investing, ask yourself if you’ve got the time, resources, and smarts to make it work.

Combining Strategies for Optimal Results

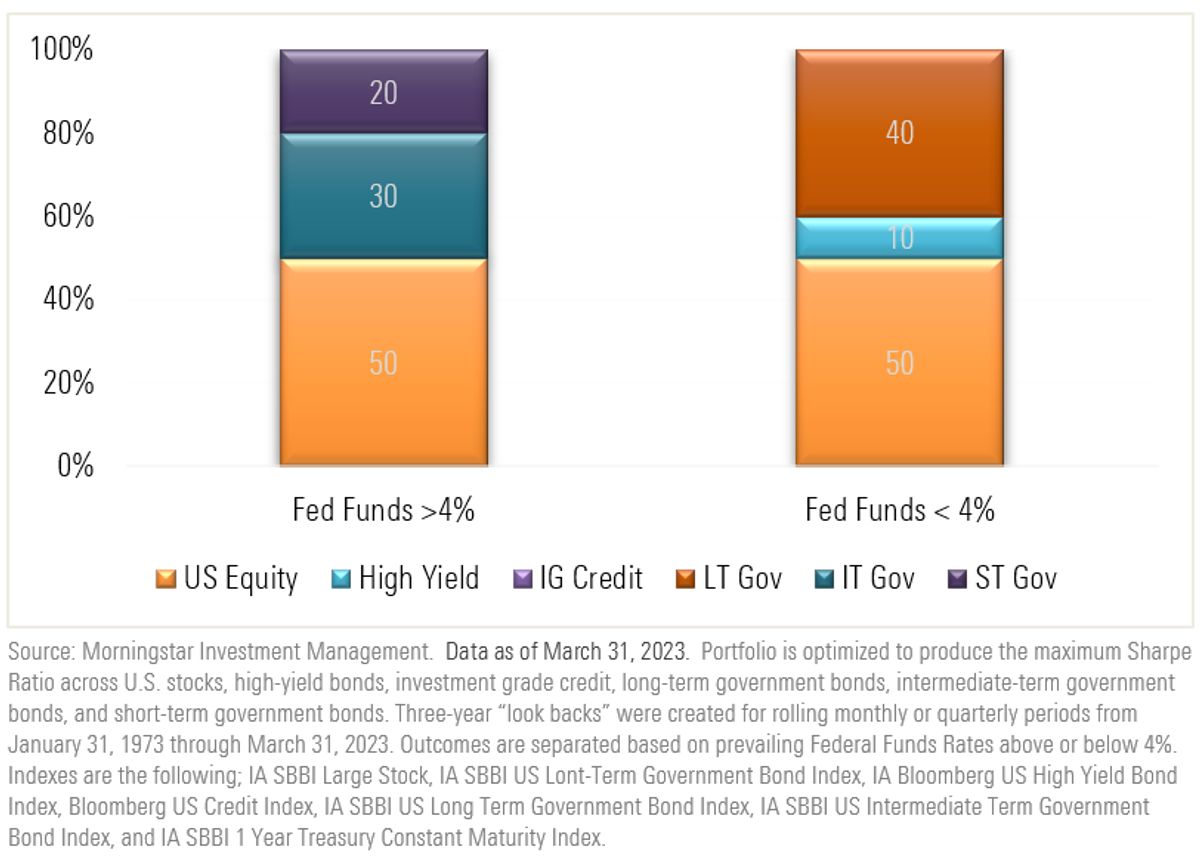

So you’ve heard about going all-in on either passive or active investing, but what if I told you there’s a middle ground? Mixing it up might just be your ticket to a killer portfolio. By playing both sides, you can snag the steady returns of passive investments and still have the chance to hit it big with active picks.

Here’s the deal: a combo platter of investment strategies lets you spread your bets. You get the chill vibes of index funds with the thrill of hand-picking stocks. It’s like having your cake and eating it too, but with your cash.

- Passive: Sit back and let the market do its thing.

- Active: Dive in and play the market like a pro.

And remember, this isn’t a set-it-and-forget-it kind of deal. You gotta stay on your toes, keep an eye on the market, and shuffle your deck when the game changes. Because let’s face it, the market’s mood swings more than a teenager.

By blending the best of both worlds, you’re setting yourself up for success without putting all your eggs in one basket.

Just don’t forget to check in on your investments. A little tweak here and there can go a long way. And hey, who says you can’t have the best of both worlds?

Laying the Groundwork for Early Investment Success

Strategies for the Aspiring Investor

Hey there, future investment guru! Ready to dive into the world of investing? Starting early is your golden ticket to potentially massive gains down the line. But before you jump in, you gotta have a game plan. Here’s a quick rundown to get you rolling:

- Start as soon as you can: Time is money, friend, and the earlier you start, the more you can benefit from the magic of compounding interest.

- Figure out what you can invest: Be real with your budget. It’s not just about throwing cash into the market; it’s about smart, sustainable investing.

- Open that investment account: No account, no investing. It’s that simple. Get yourself a reliable platform where your money can start working for you.

- Choose your strategy wisely: Are you a risk-taker or more on the cautious side? Your strategy should reflect your risk tolerance.

- Know your options: Stocks, bonds, mutual funds… the list goes on. Get to know them, because they’re the tools you’ll use to build your empire.

Remember, investing isn’t a sprint; it’s a marathon. Patience and persistence are key. You’re not just investing money; you’re investing time and effort into your future self.

Navigating through different investment strategies is crucial for achieving financial success. Whether you’re conservative or ready to ride the market rollercoaster, there’s a strategy out there for you. Just make sure to stay informed and keep your eyes on the prize!

Building a Diverse and Resilient Portfolio

Diversifying your investment portfolio is like creating a culinary masterpiece; you need a variety of ingredients to make the dish complete. By spreading your investments across different asset classes, you’re not putting all your eggs in one basket. This approach can help cushion the blow if one sector takes a hit, keeping your financial goals on track.

Here’s a quick rundown on asset allocation:

- Stocks: The spice of your portfolio, offering potential for high returns.

- Bonds: The bread and butter, providing steady income and stability.

- Mutual Funds: A mix of flavors, allowing for diversification within a single investment.

Remember, a well-diversified portfolio isn’t just about mixing different types of investments; it’s about finding the right balance for your individual risk appetite and long-term goals.

Alternative investments, like real estate and commodities, add an exotic twist to your portfolio mix. They can be particularly enticing for those looking to step outside the traditional stock and bond markets. But as with any investment, it’s crucial to do your homework and understand the risks involved.

The Importance of a Long-Term Perspective

Hey there, savvy investor! Let’s talk about playing the long game. A long-term approach is your golden ticket to the compounding wonderland. Imagine planting a tiny seed and watching it grow into a towering tree. That’s what your investments can do over time, given the magic of compounding returns.

Here’s a quick breakdown of why you should stick it out for the long haul:

- Ride out the market’s mood swings: Short-term fluctuations? Pfft, just background noise. Keep your eyes on the prize and those long-term goals.

- The tortoise beats the hare: Slow and steady wins the race. By staying the course, you’re more likely to see your financial dreams cross the finish line.

- Fundamentals are your BFF: Dive into the nitty-gritty of your investments. Solid fundamentals often mean a brighter future for your bucks.

Embrace the journey, not just the destination. By keeping a level head and a clear focus on where you’re headed, you’ll navigate the investment waters like a pro.

Remember, it’s not just about picking winners; it’s about staying in the game. Review your game plan now and then, tweak it if you must, but always keep that long-term vision in your sights. After all, time is the most valuable player on your team.

Wrapping It Up: Smart Investing Unlocked

Alright, folks, we’ve journeyed through the twists and turns of smart investment strategies, from the stability of pre-owned vehicles to the savvy of investing in what you know. Remember, the key to a thriving portfolio is a mix of informed decisions, a dash of industry know-how, and a sprinkle of innovation. Keep your eyes peeled for undervalued assets, balance those risks with rewards, and don’t shy away from seeking advice when the waters get murky. Whether you’re an early bird investor or a seasoned entrepreneur, these strategies are your compass to financial success. So go ahead, give your portfolio that extra edge and watch your investments flourish!

Frequently Asked Questions

What are some smart investment strategies for diversifying my portfolio?

Investing in different assets when they become undervalued, such as pre-owned vehicles, can be a smart strategy. Additionally, focusing on industries you understand, leveraging your knowledge and network, and balancing passive and active investment approaches can help diversify your portfolio.

How can pre-owned vehicles contribute to investment portfolio stability?

Pre-owned vehicles offer a unique blend of purchasing opportunities and can bring robustness to your investment spread due to their potential for value retention and growth, providing stability amidst market volatility.

What should I consider when engaging in cross-border payments for investment?

When involved in global transactions, it’s important to choose the right platforms and currencies and to understand the risks associated with international trade to ensure secure and profitable investments.

How can my industry knowledge influence my investment decisions?

By investing in areas you’re familiar with, you can spot opportunities that others may miss and make informed decisions based on your industry insights and connections.

What is the difference between passive and active investing?

Passive investing involves holding investments over the long term with minimal trading, while active investing requires a hands-on approach to buying and selling assets. Combining both strategies can potentially yield optimal results.

What are some effective strategies for early investors?

Early investors should focus on building a diverse and resilient portfolio, understanding the importance of a long-term perspective, and regularly tracking and rebalancing their investments to align with their goals.