Crowdpear Review

Get a 0.5% Bonus

Highlights

- Earn up to 11.19% APY

- Powered by Peerberry

- Regulated Platform

- Tested Platform

Statistics

Year Founded

2023

Investors earnings

€ 71.907

Number of Investors

4.903

Loss of Investors Money

€ 0

Interest

€ 8%-13%

Average portfolio Size

€1.343

loan Period in Months

12-18

Latest Financial Report

Not available

Table of Contents

Crowdpear Review Summary

Crowdpear is a compliant crowdlending platform based in Lithuania, providing investment opportunities in high-performing loans backed by mortgages. This crowdfunding platform offers enhanced security measures and promising returns of over 10% annually.

What is Crowdpear?

Crowdpear, a regulated Lithuanian crowdfunding platform, facilitates investments in secured business loans offering a lucrative 10.5% interest rate. With a minimum investment of only €100 per loan, interest accrual occurs quarterly and is credited to your account. Curious if Crowdpear aligns with your investment goals? Explore further in our detailed Crowdpear review.

PROS

- Regulated Crowdfunding platform

- High interest rates

- No Cash Drag

- Modern P2P lending platform

- No fees

- Option to invest as a company

CONS

- Low availability of loans

- limited difersification

Our Opinion Of Crowdpear

Crowdpear, a recently established regulated crowdfunding platform, presents competitive yields and is managed by a seasoned and reliable team.

The platform’s performance thus far has been commendable, positioning Crowdpear as a potential strong contender among platforms like EstateGuru within the crowdfunding sphere.

The real estate loans available on Crowdpear, all secured by primary mortgages, provide added security for investors.

Though there is room for enhancement, Crowdpear stands out as a viable alternative for investors facing cash drag on other platforms, offering a better avenue to maintain invested funds.

Loan availability has shown consistent growth in recent months on Crowdpear, allowing investors to deploy more capital without encountering cash drag. We’ve had a positive experience since our early 2013 investments on Crowdpear, receiving timely interest payments without any delays.

User Requirements

- Be over 18 years old

- Pass the KYC

- Verify your identity

- Verify your bank account (IBAN)

Peerberry Loyalty Bonus

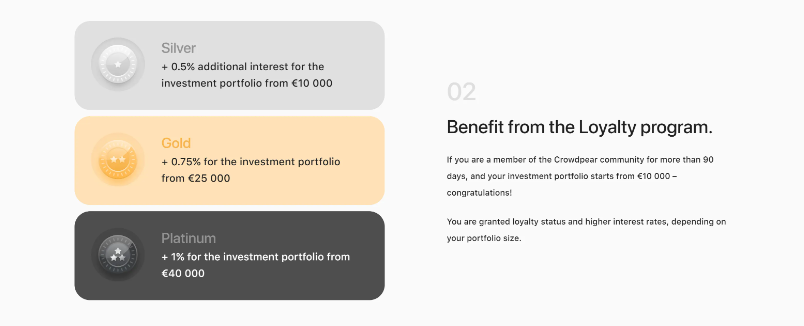

PeerBerry offers three tiers of loyalty bonuses:

- Silver: For portfolios surpassing €10,000, investors receive a 0.5% bonus.

- Gold: Portfolios exceeding €25,000 qualify for a 0.75% bonus.

- Platinum: Investors with portfolios over €40,000 are eligible for a 1% bonus.

To avail of these rewards, simply sign up for PeerBerry and commence your investment journey. The platform will apply the PeerBerry bonus solely to your active investments when your portfolio size meets the specified bonus criteria.

Crowdpear Bonus

Sign up with our link on Crowdpear and invest to receive a 0.5% bonus of your invested capital within 90 days after your registration.

In addition to your investment bonus, you will receive additional rewards if your portfolio reaches €10,000 (+0.5%); €25,000 (+0.75%); and €40,000 (+1%).

Logically, you have to invest money to get a higher interest rate.

The loyalty bonus won’t be added to your account if your funds aren’t invested.

Please be informed that you can become part of the loyalty program only after registering on Crowdpear for at least 90 days.

Crowdpear Requirements

- be at least 18 years old

- reside in the EU or EEA

- pass the AML and KYC questionnaire (multiple choice)

- verify your identity

- declare your tax residency

The entire sign-up process can be done within five minutes. The verification happens through your smartphone, so ensure your phone is closed when verifying your identity.

Crowdpear supports registrations of natural persons as well as companies.

If you are risk-cautious, we highly recommend activating the 2FA to protect your account.

Risk & Return

Investing in loans carries inherent risks, even on platforms like Crowdpear. However, Crowdpear allows investors to participate in Lithuanian real estate loans secured by a primary mortgage.

An interesting aspect exclusive to Crowdpear is that investors start earning interest immediately upon investing in a loan, unlike most other crowdfunding platforms where interest accrual begins only after the loan is fully funded. This unique feature boosts the potential return for investors on the platform.

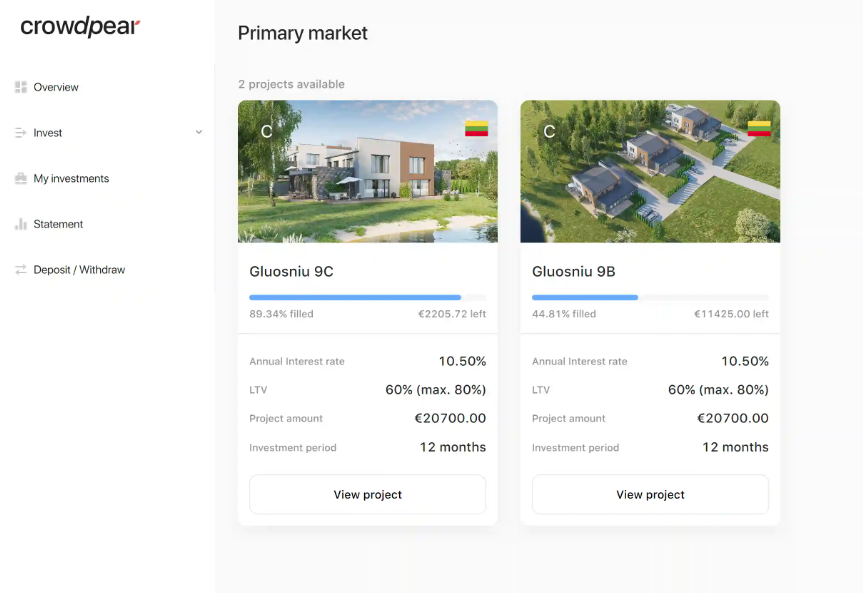

The current Loan-to-Value (LTV) ratio of listed loans on Crowdpear stands at approximately 60%, with potential to rise to 80% in subsequent stages.

Stage Loans

Investing in multi-stage loans from a single borrower can elevate investment risk since such projects are commonly funded in sequential phases.

In this situation, diversification, a strategy often used to mitigate risk by spreading investments across various assets or borrowers, may not apply. If difficulties arise for the borrower in repaying one stage of the loan, it might indicate potential challenges with subsequent stages. Consequently, seasoned investors typically steer clear of multi-stage loans to minimize the risk associated with the borrower’s repayment capability.

Usability

Crowdpear features a simplistic user interface presenting crucial information in an easily accessible manner, ensuring straightforward navigation for users familiar with crowdfunding platforms. Key details can be promptly accessed, facilitating swift investment decisions.

The primary market interface on Crowdpear is user-friendly, offering a comprehensive overview of available loans for potential investment.

Although an auto-invest feature isn’t currently provided due to the relatively low loan volume, investors might anticipate this option as the platform expands its project offerings.

Crowdpear furnishes transaction and tax statements, offering investors a quick overview of their investment performance within specific periods.

At present, Crowdpear doesn’t support individual IBAN accounts. This simplifies deposit and withdrawal processes for investors as it doesn’t require additional verification through another payment provider. Deposits can be made directly to Crowdpear’s bank account, accompanied by your payment details for proper allocation by the platform.

Liquidity

Crowdpear’s liquidity is constrained due to the 12-month loan term for all listed loans. However, the platform recently introduced a secondary market, enabling investors to trade their investments before loan repayment.

Selling an investment is a straightforward process: head to “My Investments” in the menu, select the desired investment, click the cart icon, confirm your listing, and adhere to the 14-day validity period. There’s a 2% seller fee, while buyers aren’t charged any fees.

Investors can list their investments at up to a 25% discount, but it’s essential to note that only complete investments in a single loan can be sold. Larger investments in a single loan might face challenges finding buyers.

Crowdpear’s secondary market offers increased liquidity by allowing investors to trade their investments before the loan term ends.

Support

Crowdpear’s support is managed by the same team responsible for PeerBerry, known for their exceptional customer service. If you haven’t located the information you need in Crowdpear’s FAQ section, you can reach out to Crowdpear via email at info@crowdpear.com. Typically, responses are prompt, often within a few minutes during regular business hours.

Crowdpear alternatives

The quantity of newly introduced projects on Crowdpear remains limited due to the platform’s cautious growth strategy. Establishing a diversified portfolio on Crowdpear might require several months, prompting consideration of viable alternatives.

LANDE LANDE stands as one of Latvia’s leading crowdfunding platforms, offering investors an approximate annual interest of 11% through secured agricultural loans. Investments on LANDE are safeguarded by various forms of collateral, including crops, insurance, and additional collateral types.

Recognized for its transparency, LANDE maintains an exceptional track record, providing investors with a dedicated statistics page detailing LANDE’s portfolio performance. Explore more about LANDE in our LANDE review.

Heavy Finance Located within close proximity to Crowdpear’s headquarters in Vilnius, Lithuania, Heavy Finance presents a comparable investment opportunity to LANDE. However, Heavy Finance loans are backed by heavy machinery rather than agricultural produce.

Regulated by the Central Bank of Lithuania, Heavy Finance mirrors Crowdpear in terms of platform regulation, thus reducing investment risk. Heavy Finance serves as a viable alternative by offering a distinct loan type – agricultural loans, supporting food production. Learn more about this platform in our Heavy Finance review.

InRento InRento introduces a distinctive investment opportunity by allowing investors to participate in buy-to-let projects, generating yields directly from rented apartments. Selected projects may also provide capital gains upon unit sale.

All loans on InRento are secured by a first-rank mortgage. Historically, InRento’s Lithuanian projects have displayed some of the lowest-risk investments within the P2P lending industry. Dive deeper into InRento’s offerings in our InRento review.

Crowdpear News

FaQ About Crowdpear

Esketit is a reputable peer-to-peer lending platform that showcases loans from well-established loan originators across multiple countries. We have personally visited Esketit’s headquarters and engaged in multiple discussions with the management to verify the platform’s legitimacy.

Investors utilizing Esketit will continue to receive accrued interest for delayed loans until the loan is fully repaid or until the buyback guarantee is triggered. Even in cases where loans face delays, investors will still earn interest on their investments

The T&C’s apply for the Irish company. The Latvian company is in the first line and most probably, that’s what creates the confusion. The Latvian company does some back-office work for the Irish company. The company that serves the platform is registered in Ireland.

There are multiple avenues to engage in business within the market. One can opt to operate as a commercial lender under the regulation of the Companies Control Department, establish as a microfinance company holding a license issued by the Central Bank of Jordan, or function as a sharia-compliant lender, adhering to the principles outlined in Islamic law.

Capitacritique.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Capitacritique does not include information about every financial or credit product or service.