Robocash Review

Get a 0.5% Bonus

Highlights

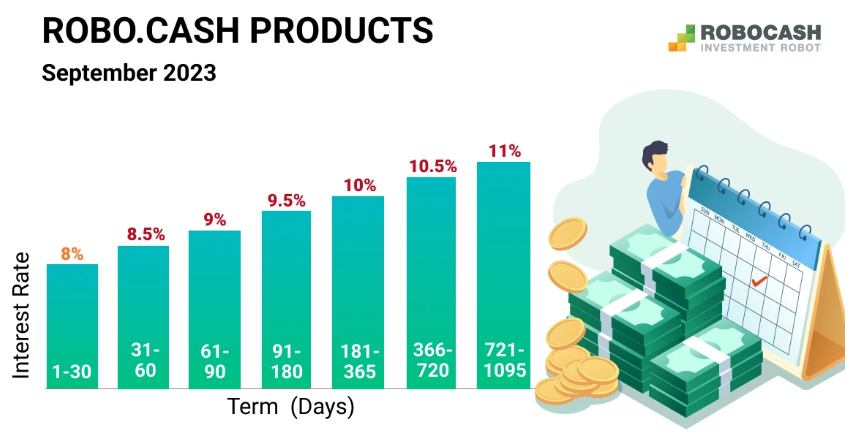

- Earn up to 8%- 11% APY

- Buyback Guarantee

- Autoinvest

- Tested Platform

- CashBack

- Regulated

Statistics

Year Founded

2017

Investors earnings

€ 20M

Number of Investors

35.000

Loss of Investors Money

€ 0

Interest

€ 8%-11%

Average portfolio Size

€3.817

loan Period in Months

1-24

Latest Financial Report

Table of Contents

Robocash Review Summary

Robocash is a peer-to-peer (P2P) lending platform that operates under registration in Croatia. The platform specializes in funding short-term loans secured by its 30-day buyback guarantee, offering investors an annual yield of up to 12%.

Established in 2017, Robocash has successfully disbursed over €20 million to a substantial investor base of more than 35,000 individuals. To ascertain the safety and reliability of Robocash, delve deeper into our comprehensive Robocash review for a detailed assessment of the platform.

Robocash offers a user-friendly P2P lending platform featuring a dependable buyback guarantee and a consistent annual return of up to 11%. The platform consistently updates its portfolio performance, bolstering our confidence in Robocash. Our interaction with Robocash has been exceptionally positive

What is Peerberry?

PeerBerry stands among Europe’s leading P2P lending platforms. Since 2017, it has served over 72,000 users who collectively earned over €20M in interest. Offering short-term loans backed by a buyback guarantee, investors can enjoy interest rates of up to 12.5% annually. Curious if PeerBerry aligns with your investment goals? Dive into our detailed PeerBerry review to explore further. Robocash currently lists loans with an interest of up to 11%, which makes any investment in Robocash very attractive. Sign up now and start earning money.

PROS

- Easy to use platform

- High interest rates

- Backe by a profitable finance group

- No fees

- Secondary market

CONS

- Manual investments are not supported

- Not regulated

- Limited loan availability

- Cash drag

Our Opinion Of Robocash

Here’s a summary of the key points we mention:

Buyback Guarantee:

- Unlike some other P2P lending platforms with a 60-day buyback guarantee, Robocash offers a shorter period of 30 days.

- Robocash’s buyback guarantee allows investors to receive their funds back sooner, not having to wait for an extended period.

- The unique aspect of Robocash’s buyback guarantee is that the loan originator repays both the outstanding principal and the interest for the delayed period, a feature not common among various loan originators on other platforms like Mintos.

Continuous Earning of Interest:

- Even when borrowers are late with payments, investors on Robocash continue to earn interest on their funds, which is not halted during the delay period.

Robocash Interest Rates:

- Robocash has recently updated its product offerings, introducing interest rates based on the loan period, with rates now increased to up to 12% per year.

These aspects highlight the unique features of Robocash, such as its shorter buyback guarantee period, continuous interest earning during payment delays, and updated interest rates based on investment periods, offering potential returns of up to 12% annually. Evaluating these factors can assist investors in assessing whether Robocash aligns with their investment goals and risk tolerance levels in the P2P lending sphere.

User Requirements

- Be over 18 years old

- Pass the KYC

- Verify your identity

- Verify your bank account (IBAN)

Is Robocash Safe?

Many P2P investors inquire about the safety of investing in a particular platform. In 2020, numerous platforms that appeared legitimate suddenly halted operations, resulting in substantial financial losses for investors, amounting to millions of euros. Even in [year], there are still fraudulent schemes that one should remain vigilant and avoid.

There is no absolute assurance that such occurrences cannot transpire with any platform. However, one can enhance the likelihood of making sound investment choices by diligently researching the platform before committing funds.

Let’s explore our investigation into Robocash:

Leadership of the Company: Sergey Sedov established the Robocash investment platform. Although previously the CEO of the UnaFinancial Group, Natalya Ischenko has assumed the role, transitioning from her prior position as the COO. Natalya brings a wealth of experience, boasting two decades in the banking and auditing sectors.

For a deeper understanding of the UnaFinancial Group and Robocash, consider watching our latest P2P talk to gain personal insights into the organization’s operations.

PeerBerry also offers a mobile application for user convenience.

The PeerBerry app provides a swift overview of your portfolio. Users can easily access information about their available funds, invested funds, paid interest, and annualized net return.

A notable feature of the app includes a daily interest repayments chart.

Within the “Investments” section, users can gain insights into their portfolios, categorized by loan originators and types. Additionally, the PeerBerry app offers a dark mode for enhanced user experience. For timely updates on portfolio performance, it’s advisable to enable all notifications.

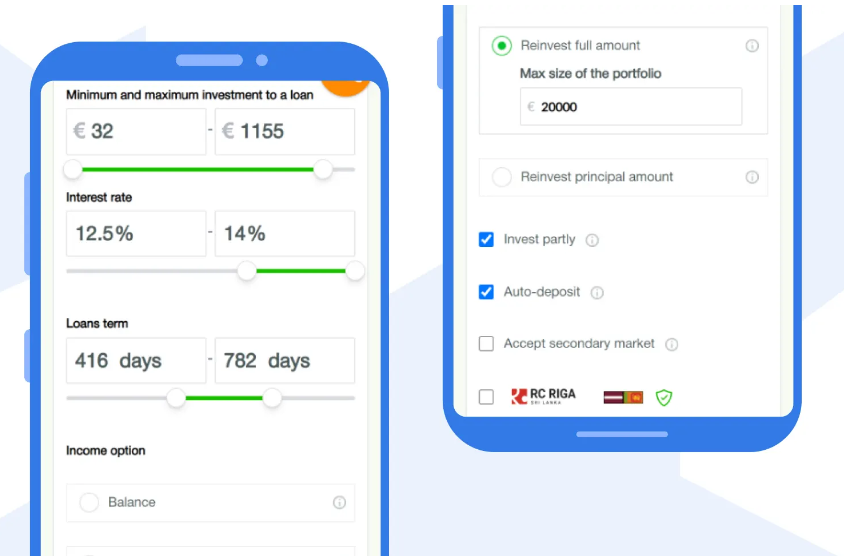

Auto Invest

Robocash doesn’t offer manual investment options; instead, you’re required to deposit funds and configure your Auto Invest settings before engaging in loan investments.

The platform allows a minimum investment of only €1 per loan, simplifying portfolio diversification compared to platforms like Reinvest24 or Heavy Finance, where the minimum investment is €100 per project.

It’s essential to note the availability of loans offered by individual lenders. You have the flexibility to specify your preferred loan criteria within your portfolio settings.

Using Robocash’s Auto Invest feature empowers you to customize:

- Portfolio size

- Minimum and maximum investment amounts

- Desired interest rates

- Investment period

- Preferred loan originator

Liquidity

Considering liquidity, which might not be top-of-mind but is crucial, is essential.

During uncertain financial times or when exploring alternative investment avenues, quick access to your invested capital becomes paramount.

Robocash facilitates liquidity through a secondary market available for all investments, allowing you to sell and exit your investments within a few days.

Investing in P2P marketplaces or platforms focused on short-term loans enhances the accessibility of your investments.

Robocash has demonstrated efficient liquidity management, meeting its obligations without reports of negative investor experiences related to liquidity concerns such as pending payments, suspended lenders, or funds undergoing recovery.

Even during the COVID-19 outbreak in 2020, Robocash excelled without struggles, recording profits exceeding $20 million, while consistently fulfilling its investor commitments. In 2021, the finance group furthered its success, securing a $28 million profit. Despite economic challenges stemming from the conflict in Ukraine in [year], Robocash continues to honor its commitments to investors.

Support

The customer support team at Robocash is notably responsive.

They have consistently addressed any inquiries we’ve raised within a 48-hour timeframe. You can reach them via email at support@robo.cash or by calling +385 1344-58-18. Alternatively, filling out their contact form ensures a prompt response from the team.

Despite being a smaller P2P platform registered in Croatia, Robocash typically offers commendable support services. Utilizing Robocash’s Live Chat function directly on their website is recommended for efficient communication.

Despite the relatively limited loan availability on Robocash, it remains one of the most dependable P2P lending platforms in the market.

Robocash alternatives

Robocash stands as a reliable platform; however, investing in [month] [year] may pose challenges due to limited loan availability. Should you contemplate investing a substantial sum, it’s currently unfeasible. Exploring alternative platforms might be a more viable option to evade cash drag concerns.

Consider these Robocash alternatives:

Esketit If you value Robocash’s reliability, Esketit offers up to 12% interest coupled with a dependable buyback guarantee. The platform solely funds loans from lenders affiliated with Esketit’s owners, reducing risk through comprehensive risk management control. In [month] [year], Esketit remains one of the most favored platforms, boasting superior loan availability compared to Robocash. Dive deeper into Esketit’s functionality via our comprehensive Esketit review.

Fintown Operating from the Czech Republic, Fintown engages in crowdlending for property development and rental in Prague. Monthly interest payouts are offered for investments in available rental units. Fintown provides returns ranging from 8% to 15% based on the investment’s lock-up period, presenting a reliable avenue to promptly deploy funds without encountering cash drag. Explore more about generating passive income through our detailed Fintown review.

LANDE For diversifying investments across various loan types, LANDE serves as an apt choice. With a commendable track record in funding agricultural loans from Latvia, LANDE secures your investments with collateral such as crops and insurance. Instead of financing payday loans, your investment aids farmers in food production, offering a sustainable income potential of up to 11% per year. Delve deeper into earning avenues via our comprehensive LANDE review.

Robocash News

FaQ About Robocash

Robocash serves as a peer-to-peer lending platform allowing investors within the European Economic Area to participate in loans facilitated by the Robocash Group. Investors have the potential to earn annual interest rates ranging from 8% to 13% based on their chosen loan duration. Interest accrued from these investments is credited to investors’ accounts on a monthly basis.

Robocash adheres to all necessary legal regulations governing its investment platform based in Croatia. Its lending entities comply with local laws to ensure the lawful issuance of loans. Additionally, the Robocash Group furnishes audited consolidated financial reports, bolstering the platform’s legitimacy.

Robocash investment platform has been consistently able to fulfill the obligation towards investors. The platform provides a 2FA which increases the safety of investors’ accounts. All the listed loans on Robocash are backed by a 30-day buyback guarantee which has been honored so far.

The commercial loan obtained by RC Riga Singapore is allocated toward fostering the growth of the Robocash Group in Southeast Asia. Primarily, these funds are earmarked for the creation of financial products in the Philippines and the expansion of operations in India and Sri Lanka

Capitacritique.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Capitacritique does not include information about every financial or credit product or service.