In the realm of business and construction, performance bonds serve as vital assurances, providing financial protection and peace of mind to project owners and stakeholders alike. These bonds act as contractual guarantees, ensuring that a project is completed as specified within the agreed-upon terms and conditions. From large-scale construction projects to government contracts and beyond, understanding the intricacies of performance bonds is paramount for all parties involved. Join us as we delve into the depths of performance bonds, unraveling their complexities and shedding light on their indispensable role in the modern business landscape.

Table of Contents

What is a Performance Bond?

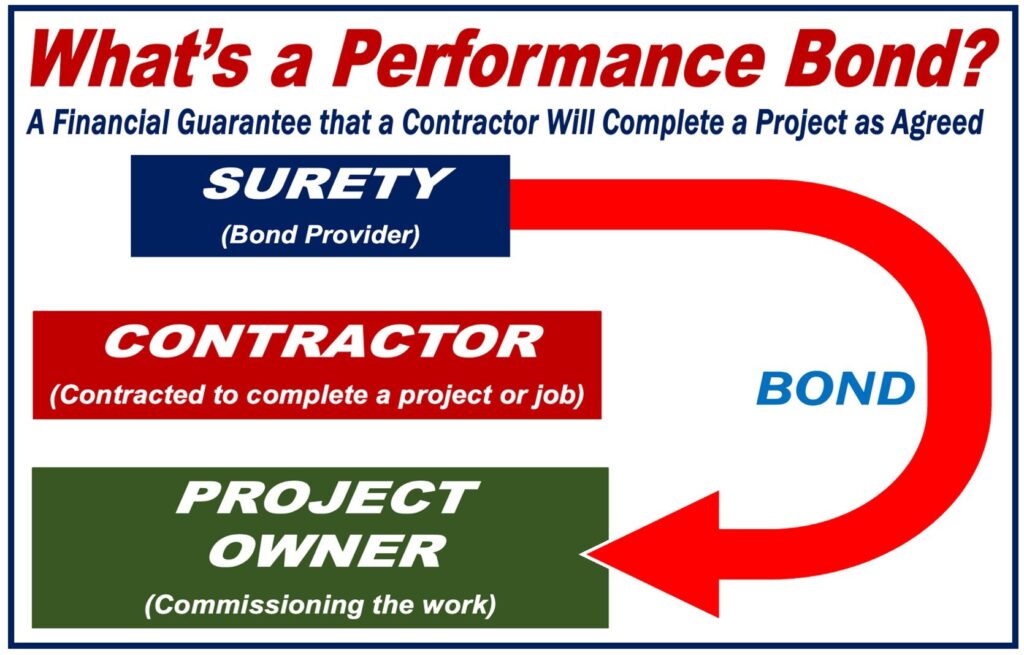

Performance bonds, also known as contract bonds, are a type of surety bond commonly used in the construction industry and other sectors to safeguard project owners against financial loss due to contractor default or failure to fulfill contractual obligations. Essentially, a performance bond is a three-party agreement between the project owner (obligee), the contractor (principal), and the surety company (guarantor).

These bonds serve as a guarantee that the contractor will complete the project according to the terms and conditions outlined in the contract. If the contractor fails to meet these obligations—for example, by abandoning the project, delivering substandard work, or failing to adhere to agreed-upon timelines—the project owner can make a claim against the bond to recover financial losses incurred as a result of the contractor’s default.

Performance bonds provide reassurance to project owners that they will not be left in a lurch if the contractor fails to deliver on their promises. They offer a layer of protection by ensuring that the project will be completed as intended, even if the original contractor is unable or unwilling to fulfill their obligations. This security is especially important in large-scale construction projects, government contracts, and other endeavors where significant financial investments are at stake.

In essence, performance bonds help mitigate the risks associated with construction projects and provide all parties involved with confidence and peace of mind throughout the duration of the project.

How Performance Bonds Work

Performance bonds function as a form of financial guarantee to ensure that a construction project or other contractual obligation is completed according to specified terms and conditions. Here’s a detailed breakdown of how performance bonds work:

Contract Agreement: The process typically begins with the signing of a contract between the project owner (obligee) and the contractor (principal). This contract outlines the scope of work, project specifications, timelines, and other relevant details.

Bond Requirement: In many cases, the project owner will require the contractor to obtain a performance bond as a condition of the contract. This bond serves as a guarantee that the contractor will fulfill their contractual obligations and complete the project as agreed upon.

Surety Company Involvement: The contractor, or principal, secures the performance bond from a surety company, which acts as the guarantor. The surety company assesses the contractor’s financial stability, reputation, and ability to complete the project before issuing the bond.

Bond Issuance: Once the surety company approves the bond application, the performance bond is issued and provided to the project owner. The bond typically includes details such as the bond amount, project details, and the parties involved.

Project Execution: With the performance bond in place, the contractor proceeds with the project according to the terms outlined in the contract. They are responsible for completing the work on time, within budget, and to the required standards.

Bond Protection: If the contractor fails to fulfill their obligations—for example, by defaulting on the project, delivering substandard work, or failing to meet project deadlines—the project owner can make a claim against the performance bond. The surety company then investigates the claim to determine its validity.

Claim Resolution: If the claim is found to be valid, the surety company may compensate the project owner for financial losses incurred as a result of the contractor’s default. This compensation typically comes from the bond amount and may cover additional costs associated with completing the project, such as hiring a new contractor or addressing deficiencies in the work.

Contractor Responsibility: In the event of a claim against the bond, the contractor is ultimately responsible for reimbursing the surety company for any amounts paid out to the project owner. This creates a financial incentive for the contractor to fulfill their contractual obligations and avoid defaulting on the project.

Overall, performance bonds provide project owners with a level of assurance that their investment is protected and that the contracted work will be completed as agreed upon. They also help maintain the integrity of the construction industry by holding contractors accountable for their performance and ensuring that projects are completed to the required standards.

Example of a Performance Bond

Let’s say a government agency, “ABC Infrastructure,” awards a construction contract for a new bridge to a contracting company, “XYZ Builders.” As part of the contract terms, ABC Infrastructure requires XYZ Builders to obtain a performance bond to ensure that the bridge project is completed according to specifications and within the agreed-upon timeframe.

XYZ Builders approaches a surety company, which specializes in providing performance bonds, and applies for a performance bond for the bridge project. The surety company evaluates XYZ Builders’ financial stability, track record, and ability to complete the project successfully.

After a thorough review, the surety company agrees to issue a performance bond in favor of ABC Infrastructure. The performance bond states that if XYZ Builders fails to fulfill its contractual obligations, such as completing the bridge construction or addressing any defects, the surety company will step in to compensate ABC Infrastructure for any financial losses, up to the bonded amount.

In this example, the performance bond provides ABC Infrastructure with financial protection and assurance that the bridge project will be completed as specified. It also holds XYZ Builders accountable for delivering on its contractual commitments, thereby reducing the risk for the project owner and ensuring the successful completion of the construction project.

Why Performance Bonds Are Important

Performance bonds play a crucial role in various industries, especially construction and contracting, where large-scale projects are common. Here’s a more detailed exploration of why performance bonds are important:

Risk Mitigation: Performance bonds help mitigate risk for project owners by providing financial protection in case a contractor fails to fulfill their contractual obligations. With a performance bond in place, project owners have recourse if the contractor defaults, ensuring that their investment is safeguarded. Also is a way to diversify your portfolio. Check here our guide for the best investments for 2014

Contractual Assurance: Performance bonds provide assurance to project owners that the contractor has the financial resources and capability to complete the project according to the agreed-upon terms. This reassures project owners that the contractor is committed to delivering the project as specified in the contract.

Quality Assurance: By requiring contractors to obtain performance bonds, project owners can maintain quality standards for construction projects. Contractors are incentivized to deliver high-quality work to avoid triggering the bond’s indemnity provisions, which could result in financial penalties.

Completion Guarantee: Performance bonds serve as a guarantee that the project will be completed within the specified timeframes and according to the agreed-upon specifications. This gives project owners peace of mind knowing that the contractor is contractually obligated to deliver the project as promised.

Financial Protection for Subcontractors and Suppliers: Performance bonds also protect subcontractors and suppliers involved in the project by ensuring they receive payment for their services or materials, even if the contractor defaults. This promotes fairness and stability within the construction industry’s supply chain.

Regulatory Compliance: In many jurisdictions, performance bonds are required by law for public construction projects or projects funded by government entities. Compliance with these regulations helps ensure transparency, accountability, and adherence to industry standards.

Investor Confidence: For investors financing construction projects, performance bonds provide an additional layer of security, reducing the perceived risk associated with project investments. This can attract more investors and funding opportunities for large-scale infrastructure projects.

Dispute Resolution Mechanism: In the event of disputes between project owners and contractors, performance bonds offer a structured mechanism for resolving issues. Instead of resorting to costly litigation, parties can rely on the bond’s indemnity provisions to address disputes and financial losses.

Overall, performance bonds are essential tools for mitigating risk, ensuring project completion, and maintaining integrity within the construction industry. By providing financial security and contractual assurance, performance bonds contribute to the successful execution of construction projects and the protection of stakeholders’ interests.

How Much Does a Performance Bond Cost?

The cost of a performance bond varies depending on several factors, including the size and complexity of the project, the contractor’s financial stability and track record, and the requirements of the project owner or obligee.

Typically, performance bond costs are calculated as a percentage of the total contract amount. This percentage, known as the bond premium rate, can range from 0.5% to 2% of the contract value. However, for larger or more complex projects, the premium rate may be higher.

Several factors can influence the premium rate:

Contractor’s Financial Stability: Surety companies assess the financial strength and stability of the contractor when determining the bond premium. Contractors with strong financials and a proven track record of completing projects successfully may qualify for lower premium rates.

Project Risk: The complexity and risk level of the construction project also affect the bond premium. Projects with higher risks, such as those involving new technologies, challenging site conditions, or tight deadlines, may command higher premium rates.

Bond Amount: The bonded amount, which represents the maximum coverage provided by the performance bond, directly impacts the bond premium. Higher bonded amounts typically result in higher premiums.

Duration of Coverage: The duration of the performance bond coverage, which is usually aligned with the project timeline, can influence the premium rate. Longer project durations may entail higher premiums.

Surety Company Requirements: Each surety company may have its own underwriting criteria and pricing structure. Contractors may obtain quotes from multiple surety companies to compare premiums and select the most competitive offer.

It’s essential for contractors to factor in the cost of performance bonds when bidding on construction projects. While performance bonds provide financial protection and demonstrate the contractor’s reliability, they also represent a significant expense that affects project profitability. Working with a reputable surety agent or broker can help contractors navigate the bond procurement process and secure competitive bond terms.

How Long Does a Performance Bond Last?

The duration of a performance bond typically aligns with the timeline of the construction project for which it is issued. Performance bonds are designed to provide coverage for the duration of the contract period, ensuring that the project owner is protected against contractor default or failure to perform according to the terms of the contract.

Key factors influencing the duration of a performance bond include:

Contract Period: Performance bonds are generally effective for the duration of the construction contract specified in the bond document. This period typically starts from the commencement of the project and extends until the completion of all work outlined in the contract.

Warranty Period: Some construction contracts may include a warranty period during which the contractor is responsible for addressing any defects or issues arising from the completed work. In such cases, the performance bond may remain in effect until the end of the warranty period, providing additional coverage beyond project completion.

Statutory Requirements: In some jurisdictions, statutory regulations or project specifications may dictate the minimum duration for performance bond coverage. Contractors and project owners should familiarize themselves with applicable laws and requirements governing performance bonds in their jurisdiction.

Surety Company Policy: The terms and conditions of the performance bond, including its duration, are outlined in the bond document issued by the surety company. Contractors should review the bond terms carefully to understand the duration of coverage and any renewal or extension provisions.

In summary, the duration of a performance bond is contingent upon the terms of the construction contract, statutory regulations, and the policies of the surety company issuing the bond. Contractors and project owners should communicate effectively and ensure that the bond coverage aligns with the project timeline to mitigate risks and protect their respective interests throughout the construction process.

Conclusion

In conclusion, performance bonds are indispensable instruments that provide vital protection and assurance in the realm of construction and contracting. Through their role in mitigating risks, ensuring contractual compliance, and safeguarding financial interests, performance bonds serve as linchpins for the successful execution of projects both large and small. You can check here our best low risk investments.

These bonds not only offer peace of mind to project owners but also foster transparency, accountability, and stability within the construction industry. By requiring contractors to obtain performance bonds, stakeholders can uphold quality standards, protect the rights of subcontractors and suppliers, and navigate potential disputes with confidence.

Furthermore, the regulatory mandates and investor expectations surrounding performance bonds underscore their significance as essential components of project financing and risk management strategies. With their comprehensive coverage and structured mechanisms for dispute resolution, performance bonds play a pivotal role in upholding the integrity and viability of construction projects.

In essence, the importance of performance bonds cannot be overstated. As vital safeguards against unforeseen challenges and contractual breaches, these bonds facilitate the seamless execution of projects, promote trust among stakeholders, and contribute to the overall resilience and success of the construction industry.