Interactive Brokers

Why choose Interactive Brokers

Interactive Brokers is a versatile brokerage that caters to a wide range of requirements. In addition to competitive fees, it offers trading opportunities across various asset classes such as stocks, ETFs, options, and futures from global markets. Personally, I primarily utilize Interactive Brokers for my long-term stock and ETF investments, and I am highly content with the service. While beginners may initially find the platforms and services daunting, investing time to learn how to navigate them proves to be valuable, as it provides access to robust investment tools.

Pros

- Low trading fees and high interest on cash balances

- Wide range of products

- Many great research tools

Cons

- Complicated account opening process

- Complex desktop trading platform

- Understaffed customer service

- List Item

Fees

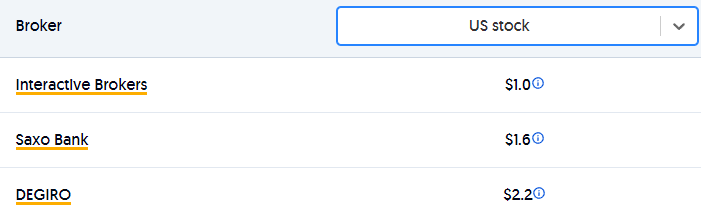

Low stock and ETF commission

Interactive Brokers offers competitive trading fees and boasts industry-leading margin rates. Clients with a net asset value of $100k or more can earn interest on their cash balances, with rates reaching up to 4.83% for USD. Additionally, for US clients opting for the Lite plan, stock and ETF trading incur no fees.

Interactive Brokers offers US stock fees that are significantly lower than the industry average. For US clients, the fees are calculated based on fixed pricing at $0.005 per share, with a minimum of $1 and a maximum of 1% of the trade value. Clients opting for the IBKR Lite plan enjoy commission-free trading. Meanwhile, IBKR Pro clients benefit from SMART routing, which automatically directs orders to the most favorable market based on price and other factors, ensuring efficient order execution.

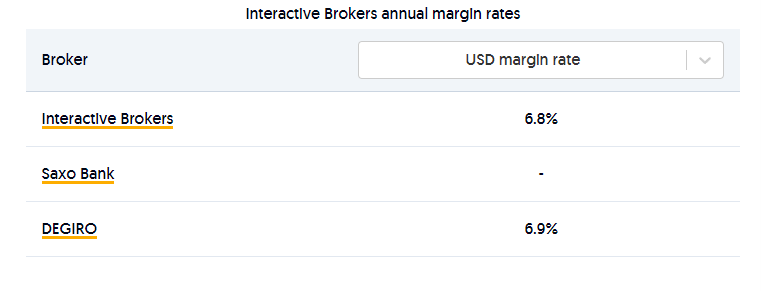

Low margin rates

Interactive Brokers offers the lowest USD margin rate fees compared to other brokers in our review. These fees are calculated using a tiered margin rate system. At IBKR PRO, the lowest tier has a rate of 6.83%, while at IBKR Lite, it’s 7.83%. For IBKR Pro customers, Interactive Brokers provides some of the most competitive margin rates in the industry. However, opting for the IBKR Lite plan may result in higher annual rates, with a markup of 2.5% for IBKR Lite accounts under $100k, compared to 1.5% for IBKR Pro accounts.

Low options commission

Interactive Brokers offers US stock index options fees that are approximately half of the industry average. These fees are calculated based on the number of contracts traded. For trades involving less than 10,000 contracts per month and for a trade of 10 contracts, the fee is $0.65 per contract with a minimum charge of $1.

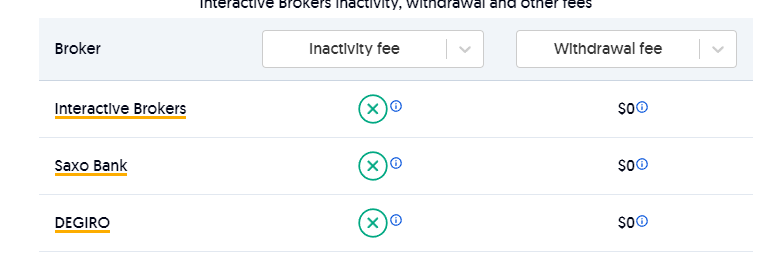

No inactivity fee, low withdrawal fee

Interactive Brokers does not impose a monthly inactivity fee, nor does it charge any account or deposit fees. Additionally, the first withdrawal each month is free of charge. However, subsequent withdrawals incur a fee, such as $10 for USD withdrawals.

Other commissions and fees

- Average mutual fund commission: $14.95 per transaction or 3% of trade value, with access to over 19,000 funds with no transaction fee.

- Low futures fees: $0.25 per contract for US index futures.

- Average FX fees: Commission of 0.2 bps * trade value for trade values less than $1 billion, with a minimum of $2. Spread costs are additional.

- Low spot crypto fees: Trading costs range from 0.12% to 0.18% of trade value, with a minimum order fee of USD 1.75 (capped at 1% of trade value).

- Low bond commission: Fee of 0.002% of trade value for US treasury bonds, with a minimum of $5 for the first $1,000,000 face value. Waived for clients using IBKR Lite.

- High index CFD fees: Commission of 0.005% of trade value with a minimum of $1 for index CFDs, with additional spread costs.

- Low stock CFD fees: Commission of $0.005 per share with a minimum of $1 for monthly volumes below $300,000.

Safety of Interactive Brokers

Interactive Brokers is regulated by multiple financial authorities, including prestigious ones such as the SEC in the US and the FCA in the UK. Moreover, its parent company is publicly listed on the US NASDAQ exchange.

Deposit and withdrawal

Pros:

- No deposit fee

- Availability of several account base currencies

- First withdrawal free each month

Cons:

- Unavailability of bank card for transactions

Account opening

Pros:

- Fully digital account opening process

- No minimum deposit required (except for margin account)

Cons:

- Complicated process

- Relatively long account verification

- Not user-friendly interface

Interactive Brokers Mobile app

Pros:

- User-friendly interface

- Good search function for assets

- Touch/Face ID login for added security

Cons:

- Limited order types available

- Lack of price alerts

Interactive Brokers offers three mobile trading platforms, each catering to different needs:

- IBKR GlobalTrader: Recommended for beginners due to its user-friendly interface and comprehensive features.

- IBKR Mobile: Provides a broad selection of assets but may be more complex for less experienced investors.

- IMPACT: Designed for ESG investing, offering a well-designed and easy-to-use platform.

Login and security

Interactive Brokers enhances security by offering a two-step login process for its mobile platform, including biometric authentication for added convenience.

The search functions within the platform are robust, allowing users to easily find the desired asset by typing its name. Screening functions are available, along with pre-selected lists of stocks or ETFs, such as value ETFs or top ESG shares. Once an asset is selected, users can view comprehensive information including price history, calendar events, fundamental data, company profile summary, analyst ratings, related news, and quick access buttons for trading actions like ‘Swap’, ‘Buy’, ‘Sell’, and ‘Options’.

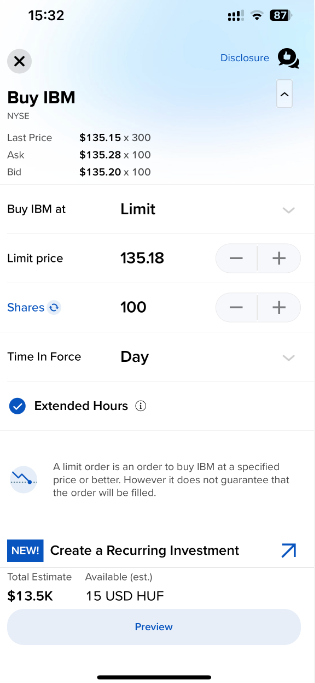

Placing orders

Order types supported on the mobile trading platform include:

- Limit

- Market

- Stop

- Swap (for portfolio stock replacement)

Time limits available for orders:

- Day

- Good till Canceled

- Outside Regular Trading Hours

Desktop platform

- Interactive Brokers’ web platform offers a user-friendly experience suitable for beginners, with clear fee reporting and safer two-step login.

- Minor glitches may occasionally detract from the overall user experience.

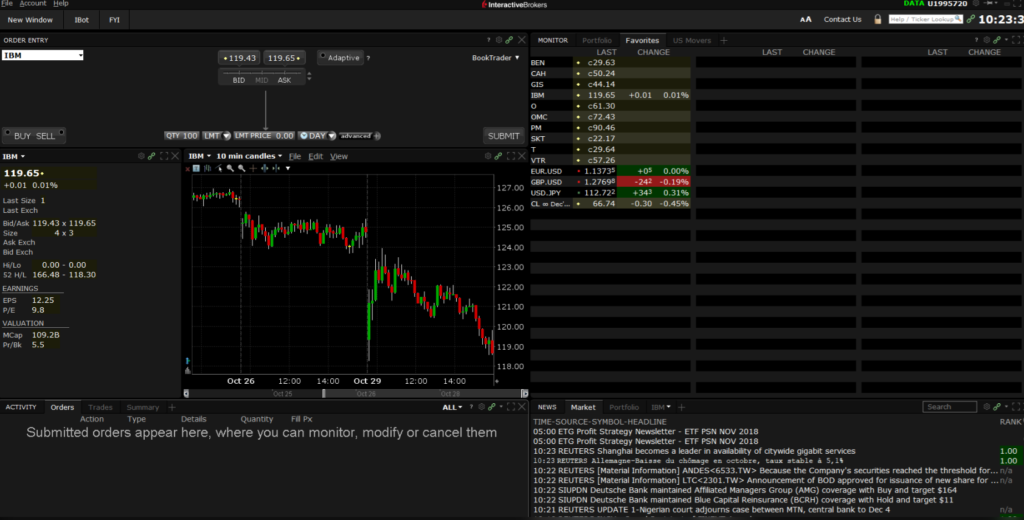

- The desktop platform, Trader Workstation (TWS), is highly advanced, offering an extensive range of features. It provides capabilities such as attaching delta hedge orders to options orders and creating charts for synthetic securities.

- TWS includes various trading algorithms, including ScaleTrader, which facilitates averaging down in declining markets or scaling out of long positions in rising markets.

- IBKR has introduced a new desktop trading platform, IBKR Desktop, available as an early preview for most clients. This platform offers similar features to TWS but with a faster, modernized interface.

- IBKR Desktop supports multiple languages, enhancing accessibility for users worldwide.

Look and feel

- Interactive Brokers’ platform, Trader Workstation (TWS), is one of the most complex platforms reviewed by BrokerChooser, offering extensive customization options such as setting up personal templates.

- TWS is well-suited for professional users who require advanced features and capabilities.

- Beginners or less active traders may find navigating TWS challenging due to its complexity. However, it’s important to note that all advanced features are optional, and users can still use TWS for basic order placement even if they don’t utilize its full range of capabilities.

final thoughts for interactive brokers

Interactive Brokers stands out as a comprehensive and sophisticated platform, offering a wide range of features and tools tailored for professional traders. With its extensive asset selection, low fees, and advanced trading capabilities, it’s a top choice for experienced investors who require robust trading functionality. However, novice traders may find the platform overwhelming due to its complexity. Despite this, Interactive Brokers remains a formidable option for those seeking a powerful trading platform with customizable features and competitive pricing.

To learn more about Interactive Brokers, you can visit their Page

You want to discover Other Options? Check our Brokers suggestions

Capitacritique.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Capitacritique does not include information about every financial or credit product or service.