Esketit Review

Possible Scam (edited 9/5/2024)

Get a 0.5% Bonus

Highlights

- Earn up to 12% APY

- Established lending companies

- Reliable buyback guarantee

- Tested Platform

- Limited diversification

Rating

Risk and return

Usability

Liquidity

Support

Diversification

Min. Investment

€ 10

Loan Originators

6

Loan Period in Months

1-36

Countries

5

Interest

7%-12%

Statistics

Year Founded

2020

Investors earnings

€ 6M

Number of Investors

16.853

Loss of Investors Money

€ 0

Average portfolio Size

€5.160

Latest Financial Report

2020

Table of Contents

Esketit Review Summary

Esketit stands out as one of the most reliable peer-to-peer lending platforms in Europe, boasting an impressive average return of 12.84%. Since April 2022, we’ve actively invested over €15,000 on Esketit, and our overall experience with the platform has been notably positive

What is Esketit?

Esketit is a peer-to-peer lending platform established by the creators of the global lending corporation AvaFin, previously known as CreamFinance. Presently, it offers investment opportunities in loans originating from Jordan, the Czech Republic, Poland, or Spain, boasting an average annual return of 12%. Curious if Esketit merits your investment? Discover the detailed insights and analysis in our comprehensive Esketit review.

PROS

- Reliable buyback and group guarantee

- High interest rates

- Modern P2P lending platform

- Instant Exit Option

- No fees

- Supported deposits in EUR or stablecoins

CONS

- Limited diversification

- Not regulated

- Limited loan availability

Our Opinion Of Esketit

Esketit has demonstrated exceptional performance in recent months, consistently safeguarding investors’ interests, even amidst ongoing geopolitical events.

Since April 2022, we’ve actively maintained a portfolio on Esketit. Although loan availability may be limited at times, our Auto Invest Strategies consistently allocate our uninvested funds within 24 – 72 hours, contingent upon prevailing market conditions.

If you don’t spot any active investments on Esketit’s homepage, it doesn’t necessarily indicate cash drag. Your uninvested funds can be deployed within 24 hours based on your Auto Invest settings.

Currently, our favored strategy involves investing in loans offered by AvaFin. You can assess our current exposure on Esketit via our P2P portfolio page.

While AvaFin holds a solid position in the global lending market, it’s crucial to recognize the inherent risks associated with investing in unsecured loans. Regulatory alterations could potentially result in losses for the company, impacting your portfolio’s performance negatively.

Joining Esketit warrants a comprehensive understanding of the lender’s loan performance in specific markets. During our visit, we engaged with Esketit’s CEO, the two founders, and the operational team handling activities in Jordan.

We acquired detailed insights into the lending landscape in Jordan, providing us with valuable perspectives on the lender’s risk management practices.

Our experience with Esketit has been outstanding thus far. As of 2024, Esketit remains one of Europe’s top-performing P2P lending platforms

User Requirements

- Be over 18 years old

- Pass the KYC

- Verify your identity

- Verify your bank account (IBAN)

Buyback Obligation & Group Guarantee

The buyback obligation signifies the commitment made by the lending company to repurchase your loan subsequent to the borrower delaying repayment for more than 60 days.

Vitālijs Zalovs is the CEO of Esketit and, therefore in charge of the platform’s operations. He has previous experience working at Mintos.

Esketit is owned by the co-founders of the Creamfinance Group, Davis Barons, and Matiss Ansviesulis. Both gentlemen have an impressive track record of growing their companies.

On the other hand, the group guarantee denotes the financial group’s commitment to fulfill the lending company’s obligation in scenarios where the lender is unable to meet the buyback obligation.

It’s important to note that the group guarantee doesn’t apply to all loans offered on Esketit, and AvanFin exclusively provides a group guarantee for its lenders. Although the lending company in Jordan isn’t part of the AvaFin group, it shares the same ownership.

Both the buyback obligation and the group guarantee are intricately linked to the financial status of the lenders or the financial group.

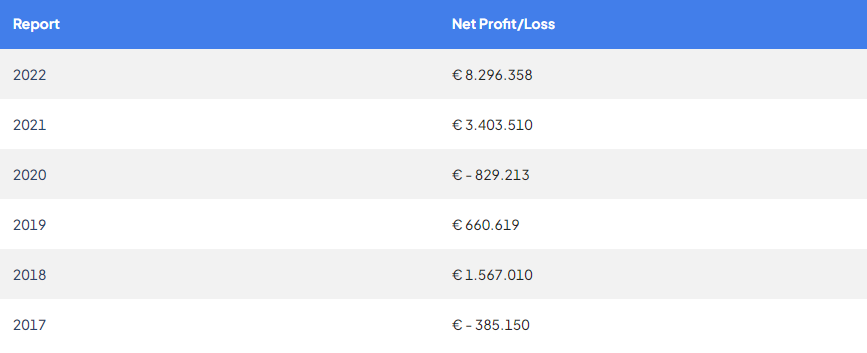

Now, let’s examine some of the reports originating from Creamfinance Holding Ltd. (AvaFin).

It’s worth noting that BDO audits all the reports in Cyprus, where Creamfinance Holding is legally based.

Esketit alternatives

In 2024, Esketit emerged as one of the premier P2P lending platforms, resulting in a limited array of viable alternatives. If your priority is diversification and you aim to introduce various loan types across different regions into your portfolio, these alternatives could be a suitable choice.

-

Income Marketplace Income Marketplace, hailing from Estonia, operates as a P2P lending marketplace facilitating investments across multiple lending companies spanning Europe, Asia, and America. Backed by a buyback guarantee, the platform offers loans, and many lenders secure their loan books to enhance investment safety. Investors can access loans yielding up to 15% annually. For comprehensive insights, delve into our Income Marketplace review.

-

LANDE Based in Latvia, LANDE specializes in agricultural loans supported by collateral such as grain or insurance. Strategically positioned just minutes away from Esketit’s headquarters in Riga, LANDE boasts a commendable track record in safeguarding investors’ interests. If you seek secured loan opportunities, LANDE stands out as a top choice in [year]. Explore more about the platform in our LANDE review.

-

Fintown Recently launched from the Czech Republic, Fintown functions as a crowdfunding platform focusing on investments in rental properties situated in Prague’s city center. With an annual interest range between 10% and 12%, investors receive payouts sourced from revenue generated by short-term rental apartments. Notably, Fintown’s co-founder is the Managing Director of Creamfinance CZ, the entity funding loans on Esketit. This platform offers attractive terms, monthly interest payments, and is detailed in our Fintown review.

Esketit News

FaQ About Esketit

Esketit is a reputable peer-to-peer lending platform that showcases loans from well-established loan originators across multiple countries. We have personally visited Esketit’s headquarters and engaged in multiple discussions with the management to verify the platform’s legitimacy.

Investors utilizing Esketit will continue to receive accrued interest for delayed loans until the loan is fully repaid or until the buyback guarantee is triggered. Even in cases where loans face delays, investors will still earn interest on their investments

The T&C’s apply for the Irish company. The Latvian company is in the first line and most probably, that’s what creates the confusion. The Latvian company does some back-office work for the Irish company. The company that serves the platform is registered in Ireland.

There are multiple avenues to engage in business within the market. One can opt to operate as a commercial lender under the regulation of the Companies Control Department, establish as a microfinance company holding a license issued by the Central Bank of Jordan, or function as a sharia-compliant lender, adhering to the principles outlined in Islamic law.

Capitacritique.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Capitacritique does not include information about every financial or credit product or service.