Investing in bonds can be an excellent way to diversify your investment portfolio and generate steady income. However, for beginners, the world of bonds may seem complex and intimidating. In this comprehensive guide, we’ll demystify the process of how to invest in Bonds, covering everything from what bonds are to how to build a bond portfolio tailored to your investment goals.

Understanding Bonds: Before diving into how to invest in bonds, it’s essential to understand what bonds are. Simply put, bonds are debt securities issued by governments, municipalities, or corporations to raise capital. When you invest in a bond, you’re essentially lending money to the issuer in exchange for regular interest payments, known as coupon payments, and the return of the principal amount, or face value, at maturity.

Table of Contents

Types of Bonds

There are various types of bonds available for investment, each with its unique features and risk profiles. Some common types of bonds include:

- Government Bonds: Issued by governments to finance public spending and projects. These bonds are considered low-risk because they are backed by the government’s full faith and credit.

- Corporate Bonds: Issued by corporations to raise capital for business operations, expansion, or acquisitions. Corporate bonds typically offer higher yields than government bonds but also come with higher credit risk.

- Municipal Bonds: Issued by state or local governments to fund public infrastructure projects such as schools, roads, and hospitals. Municipal bonds offer tax advantages for investors, making them attractive for high-net-worth individuals.

- Treasury Bonds: Issued by the U.S. Department of the Treasury, treasury bonds are considered the safest type of bond investment as they are backed by the full faith and credit of the U.S. government.

Government Bonds

Government bonds are debt securities issued by governments to raise capital. They are considered one of the safest investment options because they are backed by the full faith and credit of the issuing government. Governments issue bonds to fund various projects and initiatives, such as infrastructure development, social programs, or to cover budget deficits.

There are several types of government bonds, including:

Treasury Bonds: Issued by the government’s treasury department, these bonds typically have longer maturities, ranging from 10 to 30 years. They pay fixed interest payments semi-annually and return the principal amount at maturity.

Treasury Notes: Similar to treasury bonds but with shorter maturities, typically ranging from 2 to 10 years. They also pay fixed interest payments and return the principal amount at maturity.

Treasury Bills (T-Bills): Short-term government securities with maturities of one year or less. T-bills are sold at a discount to face value and do not pay periodic interest. Instead, investors earn a return by purchasing them at a discount and receiving the full face value at maturity.

Municipal Bonds: Issued by state or local governments, municipal bonds finance public projects such as schools, highways, or utilities. They may offer tax-exempt interest income, making them attractive to investors in high tax brackets.

Sovereign Bonds: Issued by foreign governments, sovereign bonds are denominated in the issuing country’s currency. They may offer higher yields than domestic government bonds but also carry currency and geopolitical risks.

Investing in government bonds provides several benefits:

Safety: Government bonds are considered one of the safest investments because they are backed by the issuing government’s creditworthiness and ability to tax its citizens.

Income: Government bonds pay regular interest payments, providing investors with a steady income stream.

Diversification: Government bonds can help diversify an investment portfolio, reducing overall risk by offsetting volatility in other asset classes such as stocks or real estate.

Liquidity: Government bonds are highly liquid securities, meaning they can be easily bought and sold in the secondary market.

However, there are also some considerations to keep in mind when investing in government bonds:

Interest Rate Risk: Bond prices and interest rates have an inverse relationship. When interest rates rise, bond prices fall, and vice versa. Investors may experience capital losses if they need to sell their bonds before maturity in a rising rate environment.

Inflation Risk: The purchasing power of fixed-income investments like bonds may be eroded by inflation over time. Investors should consider the potential impact of inflation on their bond returns.

Credit Risk: While government bonds are generally considered low-risk, there is still a possibility of default, especially with bonds issued by foreign governments or municipalities. Investors should assess the creditworthiness of the issuing entity before investing.

In summary, government bonds offer a secure and predictable investment option for investors seeking income and capital preservation. However, investors should carefully consider their investment objectives, risk tolerance, and market conditions before investing in bonds.

Corporate Bonds

Corporate bonds are debt securities issued by corporations to raise capital for various purposes, such as financing operations, expanding business activities, or funding acquisitions. When investors purchase corporate bonds, they are effectively lending money to the issuing company in exchange for regular interest payments and the return of the principal amount at maturity.

Here are some key features and considerations regarding corporate bonds:

Types of Corporate Bonds: Corporate bonds can be classified based on their maturity, credit quality, and whether they are secured or unsecured. Some common types include:

- Investment-Grade Bonds: Issued by companies with strong credit ratings, investment-grade bonds are considered relatively safe and typically offer lower yields.

- High-Yield Bonds (Junk Bonds): Issued by companies with lower credit ratings, high-yield bonds offer higher yields to compensate investors for the increased risk of default.

- Convertible Bonds: Convertible bonds give bondholders the option to convert their bonds into a predetermined number of the issuer’s common stock.

- Secured Bonds: Backed by specific assets of the issuing company, secured bonds provide investors with additional collateral in case of default.

- Unsecured Bonds (Debentures): Unsecured bonds are not backed by collateral and rely solely on the issuer’s creditworthiness.

Credit Risk: Corporate bonds carry credit risk, which is the risk that the issuing company may default on its debt obligations and fail to make timely interest payments or repay the principal amount. Investors should assess the creditworthiness of the issuing company by reviewing its credit ratings and financial health before investing in corporate bonds.

Yield and Interest Payments: Corporate bonds pay regular interest payments, typically semi-annually or annually, based on the bond’s coupon rate. The yield on a corporate bond is influenced by factors such as prevailing interest rates, credit quality, and market demand.

Maturity: Corporate bonds have fixed maturity dates, ranging from a few years to several decades. Investors can choose bonds with maturities that align with their investment objectives and time horizon.

Liquidity: Corporate bonds are traded in the secondary market, providing investors with liquidity and the ability to buy or sell bonds before maturity. However, liquidity can vary depending on factors such as the bond’s credit rating, issuance size, and market conditions.

Tax Considerations: Interest income from corporate bonds is typically subject to federal and state income taxes. However, certain types of corporate bonds, such as municipal bonds issued by state or local governments, may offer tax-exempt interest income.

Investing in corporate bonds can offer several benefits, including:

- Fixed Income: Corporate bonds provide investors with a predictable stream of income through regular interest payments.

- Diversification: Corporate bonds can help diversify an investment portfolio by adding an asset class with potentially lower correlation to stocks.

- Potential for Capital Appreciation: If interest rates decline or the issuing company’s creditworthiness improves, corporate bond prices may increase, leading to capital gains for investors.

However, it’s essential to carefully evaluate the risks associated with corporate bonds, including credit risk, interest rate risk, and liquidity risk, before making investment decisions. Investors should conduct thorough research, consider their risk tolerance and investment objectives, and consult with financial advisors if needed.

Municipal Bonds

Municipal bonds, often referred to as “munis,” are debt securities issued by state or local governments, municipalities, or related agencies to raise funds for public projects such as infrastructure development, schools, hospitals, and utilities. Municipal bonds are popular among investors seeking income while enjoying potential tax advantages. Here are some key points to understand about municipal bonds:

Types of Municipal Bonds: Municipal bonds can be categorized into two main types based on how they are repaid:

- General Obligation (GO) Bonds: Backed by the full faith, credit, and taxing power of the issuing municipality, GO bonds are considered relatively secure and may offer lower interest rates.

- Revenue Bonds: Secured by the revenue generated from a specific project or source, such as toll roads, airports, or water/sewer systems, revenue bonds are typically riskier but may offer higher yields.

Tax Advantages: One of the primary attractions of municipal bonds is their potential tax-exempt status. Interest income from municipal bonds issued by state or local governments is generally exempt from federal income taxes. Additionally, if investors purchase bonds issued within their state of residence, the interest income may also be exempt from state and local income taxes, providing additional tax savings.

Yield and Credit Quality: Like other bonds, municipal bonds pay regular interest payments to investors, usually semi-annually. The yield on municipal bonds is influenced by factors such as the bond’s credit rating, maturity, and prevailing market conditions. Municipal bonds are assigned credit ratings by independent rating agencies based on the issuer’s creditworthiness and ability to repay debt obligations.

Maturity and Call Provisions: Municipal bonds have fixed maturity dates, ranging from one to several decades. Some municipal bonds may include call provisions that allow the issuer to redeem the bonds before maturity, potentially affecting investors’ returns.

Credit Risk: While municipal bonds are generally considered relatively safe investments, they are not entirely risk-free. Investors should assess the creditworthiness of the issuing municipality or agency, considering factors such as its financial stability, economic conditions, and debt management practices.

Liquidity and Secondary Market: Municipal bonds are traded in the secondary market, providing investors with liquidity and the ability to buy or sell bonds before maturity. However, liquidity can vary depending on factors such as the bond’s credit rating, size, and market demand.

Investing in municipal bonds can offer several benefits, including:

- Tax-Exempt Income: The potential for tax-exempt interest income makes municipal bonds attractive to investors in higher tax brackets, providing a higher after-tax yield compared to taxable bonds.

- Diversification: Municipal bonds can help diversify an investment portfolio by adding an asset class with potentially lower correlation to stocks and other fixed-income securities.

- Preservation of Capital: Municipal bonds are generally considered less volatile than stocks, making them a suitable option for investors seeking to preserve capital while generating income.

However, investors should carefully consider their investment objectives, risk tolerance, and tax situation before investing in municipal bonds. It’s essential to conduct thorough research, evaluate the credit quality of municipal issuers, and consult with financial advisors if needed to make informed investment decisions.

Treasury Bonds

Treasury bonds, also known as T-bonds or long-term Treasury securities, are debt instruments issued by the U.S. Department of the Treasury to finance government spending and manage the national debt. Treasury bonds are considered one of the safest investments globally due to the full faith and credit of the U.S. government backing them. Here’s an overview of Treasury bonds:

Characteristics of Treasury Bonds:

- Maturity: Treasury bonds have longer maturities compared to Treasury bills and Treasury notes, typically ranging from 10 to 30 years. The longer maturity period means investors receive interest payments semi-annually over an extended period before the bond matures.

- Coupon Payments: Like other Treasury securities, Treasury bonds pay fixed interest, known as the coupon rate, which is determined at the bond’s issuance. Investors receive semi-annual interest payments based on the bond’s face value and coupon rate.

- Face Value and Par Value: Treasury bonds are issued with a face value, typically $1,000, representing the principal amount that will be repaid to the bondholder at maturity. The market price of Treasury bonds may fluctuate based on changes in interest rates and investor demand, but at maturity, bondholders receive the full face value.

- Issuance and Auctions: Treasury bonds are issued through regular auctions conducted by the U.S. Treasury Department. Investors can participate in Treasury bond auctions directly through the TreasuryDirect website or indirectly through brokerage firms.

- Liquidity: Treasury bonds are highly liquid securities, as they are actively traded in the secondary market. Investors can buy and sell Treasury bonds through brokerage accounts or directly from the U.S. Treasury Department.

Types of Treasury Bonds:

- Nominal Treasury Bonds: These are the traditional Treasury bonds that pay fixed interest rates and are not adjusted for inflation.

- Treasury Inflation-Protected Securities (TIPS): TIPS are Treasury bonds whose principal value is adjusted based on changes in the Consumer Price Index (CPI) to protect investors against inflation. TIPS pay a fixed interest rate applied to the adjusted principal value.

Benefits of Investing in Treasury Bonds:

- Safety and Security: Treasury bonds are backed by the full faith and credit of the U.S. government, making them one of the safest investments available. They are considered virtually risk-free from default.

- Income Stream: Treasury bonds provide a predictable income stream through regular coupon payments, making them attractive for income-oriented investors.

- Portfolio Diversification: Treasury bonds can serve as a diversification tool within an investment portfolio, providing stability and potentially reducing overall portfolio risk.

Considerations for Investors:

- Interest Rate Risk: Treasury bond prices are inversely related to changes in interest rates. When interest rates rise, bond prices fall, and vice versa. Investors should be aware of interest rate risk, especially when holding long-term bonds.

- Inflation Risk: While nominal Treasury bonds are not directly indexed to inflation, investors may face purchasing power erosion if inflation rates exceed bond yields. TIPS offer protection against inflation but may have lower yields compared to nominal bonds.

- Tax Implications: Interest income from Treasury bonds is subject to federal income tax but exempt from state and local taxes. However, capital gains from selling Treasury bonds before maturity are taxable.

Overall, Treasury bonds are suitable for investors seeking a safe and reliable investment option with steady income and principal protection. They can serve as core holdings in a diversified investment portfolio, providing stability and liquidity amidst market uncertainties. Investors should assess their investment objectives, risk tolerance, and time horizon before investing in Treasury bonds.

Factors to Consider When Investing in Bonds:

- Risk Tolerance: Assess your risk tolerance before investing in bonds. While government bonds are considered low-risk, corporate bonds and municipal bonds carry higher credit risk.

- Yield and Duration: Consider the yield and duration of bonds when building your portfolio. Yield represents the annual interest rate paid by the bond issuer, while duration measures the bond’s sensitivity to changes in interest rates.

- Diversification: Diversify your bond portfolio across different issuers, sectors, and maturities to spread risk and minimize exposure to any single bond or issuer.

- Interest Rate Environment: Pay attention to prevailing interest rates and their impact on bond prices. Bond prices have an inverse relationship with interest rates, meaning that when interest rates rise, bond prices fall, and vice versa.

How to Invest in Bonds

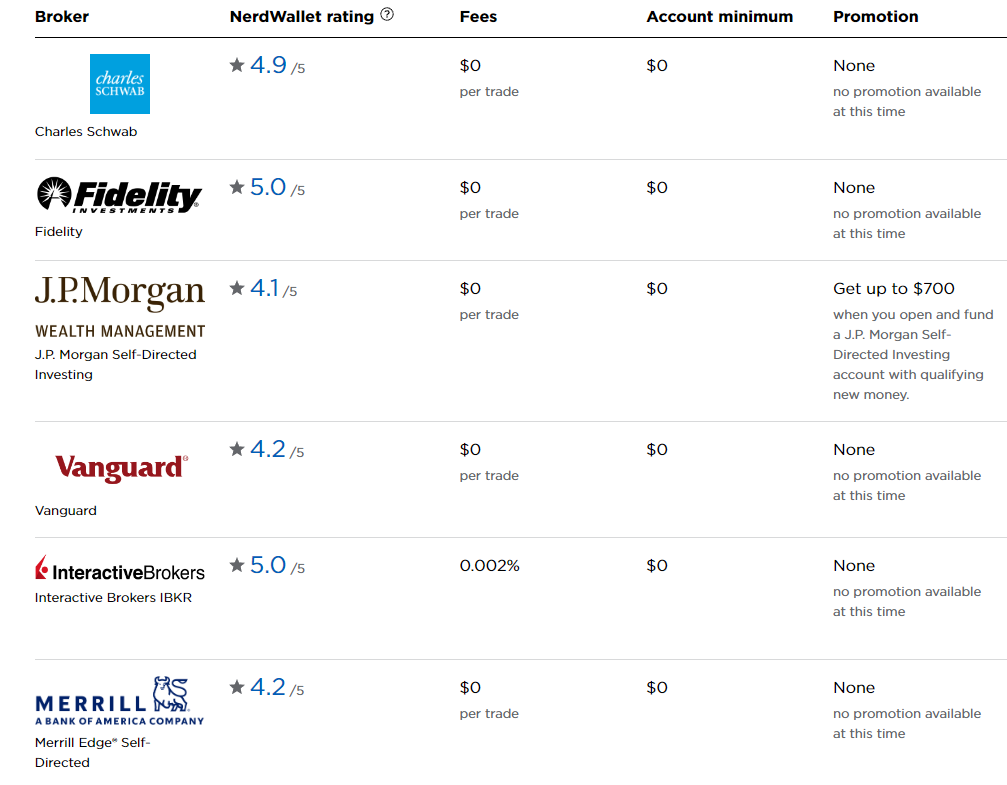

- Open a Brokerage Account: To invest in bonds, you’ll need to open a brokerage account with a reputable online brokerage firm that offers bond trading services.

- Research Bonds: Research and evaluate different bonds based on your investment objectives, risk tolerance, and time horizon. Consider factors such as credit rating, yield, maturity, and issuer profile.

- Place an Order: Once you’ve identified the bonds you want to invest in, place an order through your brokerage account. You can buy bonds directly from the issuer through a primary offering or on the secondary market through a broker.

- Monitor Your Portfolio: Keep track of your bond investments and monitor market conditions, interest rate changes, and issuer credit ratings. Rebalance your portfolio periodically to maintain your desired asset allocation and risk exposure.

Where to buy bonds

Investors can buy Treasury bonds directly from the U.S. Department of the Treasury through the TreasuryDirect website or indirectly through various channels:

TreasuryDirect: The TreasuryDirect platform allows investors to buy, manage, and redeem Treasury securities, including Treasury bonds, directly from the U.S. government. Investors can open an account for free and purchase Treasury bonds in electronic form.

Brokerage Firms: Many brokerage firms offer access to Treasury bonds and other fixed-income securities through their online trading platforms. Investors can buy Treasury bonds through brokerage accounts, which may provide additional investment tools and services.

Banks and Credit Unions: Some banks and credit unions may offer Treasury bonds to their customers through brokerage services or investment accounts. Investors can inquire with their financial institution about purchasing Treasury bonds.

Financial Advisors: Investors working with financial advisors or investment professionals can buy Treasury bonds through their advisory accounts. Financial advisors can assist clients in determining the appropriate allocation of Treasury bonds within their investment portfolios.

Bond Funds and ETFs: Investors can also gain exposure to Treasury bonds indirectly through bond mutual funds or exchange-traded funds (ETFs) that invest in Treasury securities. These funds pool investors’ money to buy a diversified portfolio of bonds, including Treasury bonds, offering liquidity and professional management.

Secondary Market: Investors can buy and sell Treasury bonds in the secondary market through brokerage firms, financial institutions, and electronic trading platforms. The secondary market provides liquidity and allows investors to trade Treasury bonds before their maturity date.

When purchasing Treasury bonds, investors should consider factors such as transaction fees, minimum investment requirements, and the availability of different maturities. It’s essential to compare pricing and services offered by different brokerage firms or financial institutions to find the most suitable option for buying Treasury bonds based on individual investment preferences and goals.

Bond market vs. stock market

The bond market and stock market are two distinct components of the financial markets, each offering different investment opportunities and characteristics. Here’s a comparison between the bond market and stock market:

Nature of Investments:

- Bond Market: In the bond market, investors buy and sell debt securities issued by governments, municipalities, corporations, and other entities. Bonds represent loans made by investors to issuers, who promise to pay periodic interest payments (coupon payments) and return the principal amount at maturity.

- Stock Market: In the stock market, investors buy and sell ownership stakes (shares or stocks) in publicly traded companies. Stockholders participate in the company’s profits through dividends and capital appreciation.

Risk and Return:

- Bond Market: Bonds are generally considered less risky than stocks, offering fixed interest payments and repayment of principal at maturity. However, bond prices may fluctuate based on changes in interest rates, credit risk, and other factors.

- Stock Market: Stocks are riskier than bonds but offer the potential for higher returns. Stock prices are influenced by company performance, industry trends, market sentiment, and economic conditions. Stockholders bear the risk of capital loss if the company’s value declines.

Income Generation:

- Bond Market: Bonds provide a predictable income stream through periodic interest payments. The interest rate (coupon rate) is determined at the time of issuance and remains fixed or variable throughout the bond’s term.

- Stock Market: Stocks may provide income through dividends, which are payments distributed to shareholders from the company’s profits. However, dividends are not guaranteed and may vary based on the company’s financial performance and dividend policy.

Market Dynamics:

- Bond Market: The bond market tends to be more stable and less volatile than the stock market. Bond prices are influenced by factors such as interest rate movements, inflation expectations, credit ratings, and economic indicators.

- Stock Market: The stock market is characterized by higher volatility and fluctuating prices. Stock prices can be influenced by various factors, including company earnings reports, news events, investor sentiment, and macroeconomic trends.

Investor Objectives:

- Bond Market: Investors in the bond market often seek capital preservation, income generation, and portfolio diversification. Bonds are commonly used by investors seeking steady returns with lower risk exposure.

- Stock Market: Investors in the stock market typically aim for capital appreciation and long-term growth. Stocks may appeal to investors willing to accept higher risk in exchange for the potential for higher returns over time.

Overall, both the bond market and stock market play vital roles in the global financial system, offering investors diverse opportunities to achieve their investment objectives based on their risk tolerance, time horizon, and financial goals. Investors often allocate their portfolios between bonds and stocks to balance risk and return and diversify their investments.

Conclusion

Investing in bonds can be a valuable addition to your investment portfolio, providing stability, income, and diversification benefits. By understanding the fundamentals of bonds, conducting thorough research, and implementing a disciplined investment strategy, you can build a bond portfolio that aligns with your financial goals and risk tolerance. Whether you’re a novice investor or an experienced one, bonds offer opportunities for both capital preservation and wealth accumulation.

In addition to exploring the world of bond investments, be sure to check out our guide on the “7 Best Monthly Dividend Stocks to Buy Now” for further diversification and income generation in your investment portfolio.