Freedom 24 Review

Pros

- Internationally Regulated Platform

- Competitive Interest Rates on Cash Balance

- Access to 15 Global Stock Exchanges

Cons

- No Fractional Shares

- Flat Withdrawal Fee of 7€

- No Copy Trading

Expert Reviewer Verdict

Discover why Freedom24 is a top choice for traders with its access to 15 global exchanges and over 1 million trading instruments. Enjoy commission-free trading for the first month, professional analytics, and robust educational resources on its user-friendly platform. While lacking fractional shares and featuring a flat withdrawal fee, Freedom24 offers 24/7 trading, diverse order options, and stringent security measures, making it an attractive option for investors seeking simplicity and comprehensive market reach.

Table of Contents

Freedom 24 Trust and Safety

A Trusted Stronghold

Regulatory Compliance: In the intricate landscape of online trading, Freedom24 shines as a symbol of security and dependability. Governed by the vigilant oversight of the Cyprus Securities and Exchange Commission (CySEC), Freedom24 adheres rigorously to stringent financial standards, ensuring full compliance with operational guidelines. This robust regulatory framework ensures a transparent and reliable environment for investors. In addition to CySEC, Freedom24 is also subject to regulations from the U.S. Securities and Exchange Commission (SEC) as part of the internationally listed Freedom Holding Corp.

Prevention of Fraud: Preventing fraud is a top priority at Freedom24. Employing cutting-edge encryption technology, the platform fortifies sensitive data and financial transactions, establishing a resilient barrier against unauthorized access. Freedom24 ensures an impenetrable defense through rigorous authentication protocols, instilling confidence in its clientele.

Security of Client Funds: The security of client funds is a fundamental principle at Freedom24. The platform meticulously maintains segregated accounts, ensuring that client funds are distinct from the company’s operational capital. This segregation not only demonstrates financial prudence but also serves as a safety measure for clients, protecting their investments even in unforeseen company challenges.

With a steadfast commitment to robust regulation, advanced fraud prevention measures, and an unwavering focus on the security of client funds, Freedom24 stands as a stronghold of trust and safety in the realm of online brokerage. Investors can navigate the complexities of financial markets with confidence, knowing they are supported by a broker that prioritizes their security and peace of mind.

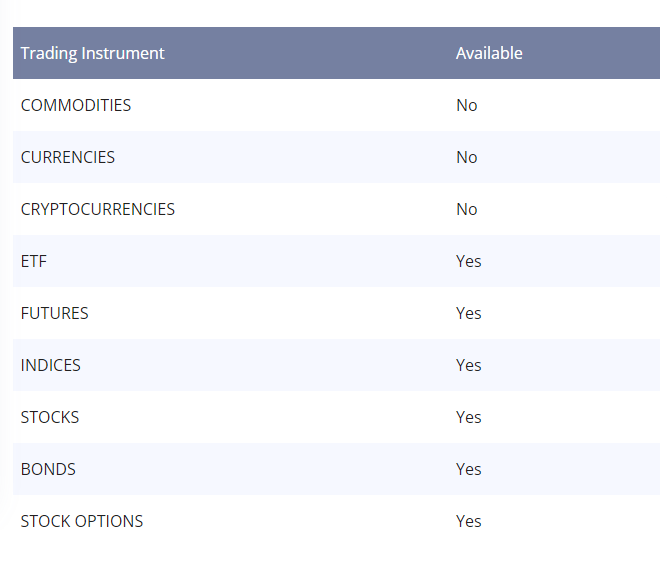

Freedom 24 Tradable Instruments

Unlocking Boundless Opportunities

Freedom24 presents a vast spectrum of tradable instruments, granting investors access to a world of possibilities at their fingertips. With direct connectivity to 15 renowned stock exchanges worldwide, spanning the USA, Europe, and Asia, Freedom24 offers a platform where over 1 million trading instruments thrive. From traditional stocks and bonds to futures, stock options, ETFs, and other exchange-traded products, the diverse range of options caters to a myriad of investment strategies.

Moreover, Freedom24 goes beyond conventional offerings. Investors can partake in open-term money placement plans, enjoying competitive interest rates of 5.31% per annum on USD balances and 3.88% per annum on EUR balances, with daily interest accrual. For those preferring fixed-term placements, enticing rates of up to 8.79% on USD and up to 6.42% on EUR are on offer. Freedom24’s interest rates are linked to the fluctuating SOFR rate for USD placements and the EURIBOR rate for EUR placements, subject to dynamic adjustments. It’s important to note that the indicated percentages are based on specific dates, and actual interest rates may vary accordingly.

This extensive array of offerings is complemented by a suite of state-of-the-art features, including proprietary market analysis curated by Bloomberg-awarded market experts. With Freedom24, traders can engage in pre-market trading, intraday, and long-term trading across major markets, empowered by a user-friendly platform accessible via web terminals and mobile applications.

Freedom24’s unwavering dedication to diversity, innovation, and accessibility positions it as an ideal choice for investors of all proficiency levels, amplifying the excitement of trading in the global financial arena.

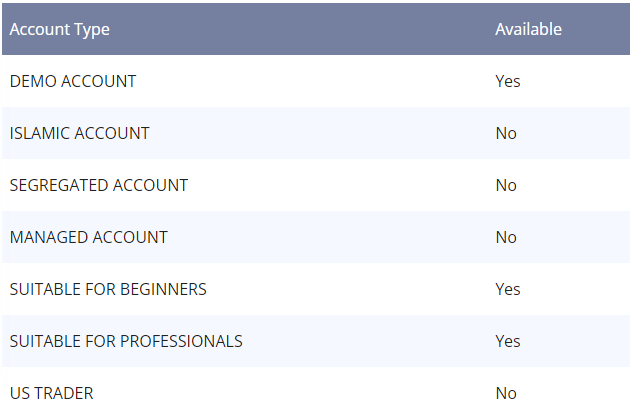

Freedom 24 Account Types

Freedom24 offers two distinct account types tailored to meet the diverse needs of investors. The trading account provides direct access to 15 prominent stock exchanges worldwide, facilitating effortless trading of stocks, ETFs, stock options, bonds, and futures.

On the other hand, the money placement plans introduce an innovative non-trading avenue. These plans enable daily interest accrual on EUR and USD balances, featuring a base interest rate of 3.88% for EUR and 5.31% for USD. Investors have the flexibility to opt for either open-term plans or fixed-term placements, with the opportunity to earn attractive interest rates of up to 8.79% on USD and 6.42% on EUR. It’s worth noting that Freedom 24’s interest rates are subject to dynamic changes, as they are tied to the SOFR rate for USD savings and the EURIBOR rate for EUR savings.

Accessible via user-friendly web terminals and mobile apps compatible with Android, iOS, and Huawei devices, these accounts ensure a seamless trading experience. With round-the-clock trading availability and robust customer support, Freedom24 offers clients across the EU an efficient and secure investment environment.

Freedom 24 Commission and Fees

- Account Minimum: No minimum deposit requirement, ensuring accessibility for investors.

- Trading Fees: Fees start at €0.008 per share/ETF and €1.2 per order.

- CFD Fees: Freedom24 does not offer CFD trading.

- Forex Fees: Currency exchange is available, but forex trading is not offered.

- Account Fee: No account fees, providing flexibility for account holders.

- Deposit Fee: No fees for bank transfer deposits.

- Withdrawal Fee: A flat withdrawal fee of €7 is charged for all withdrawals.

- Inactivity Fee: No inactivity fees, ensuring a stress-free trading experience.

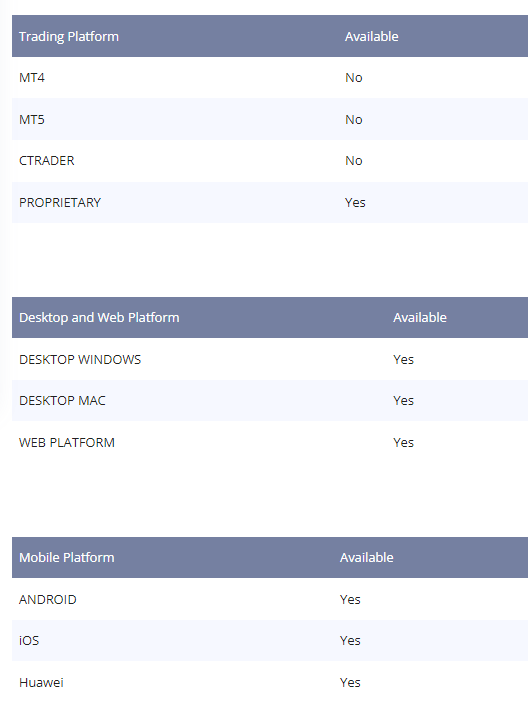

Trading Platforms

Convenience Across Devices Freedom24 offers a seamless trading experience across various platforms.

Mobile Trading Apps Accessible on Android, iOS, and Huawei devices, Freedom24’s mobile app provides convenient trading with intuitive interfaces and instant market access. This allows traders to manage their investments anytime, anywhere, ensuring flexibility and ease of use.

Web Trading Apps Freedom24’s web-based trading platform offers a user-friendly interface accessible through web browsers. Investors can trade diverse instruments, access market research, and oversee their portfolios effortlessly, enhancing their online trading journey.

Desktop Trading Apps Freedom24’s desktop trading application caters to the needs of professional traders with advanced features. This platform delivers comprehensive tools, real-time data, and thorough market analysis, catering to the preferences of experienced investors who favor a desktop trading environment.

Unique Features

Exceptional Features for Every Trader Freedom24 stands out by offering a range of compelling features aimed at enhancing the trading journey for all investors.

Global Market Access: Freedom24 provides direct access to 15 major global stock exchanges, including emerging markets such as Hong Kong, Kazakhstan, and Greece. With access to over 1 million trading instruments, investors can diversify their portfolios extensively.

Expert Market Insights: Clients benefit from expert market analysis provided by Bloomberg’s renowned professionals. Freedom24 offers complimentary stock picks, market collections, and research services. Over the past five years, 65% of investment ideas shared by Freedom24 experts have met their target prices, resulting in an impressive average return of 21%.

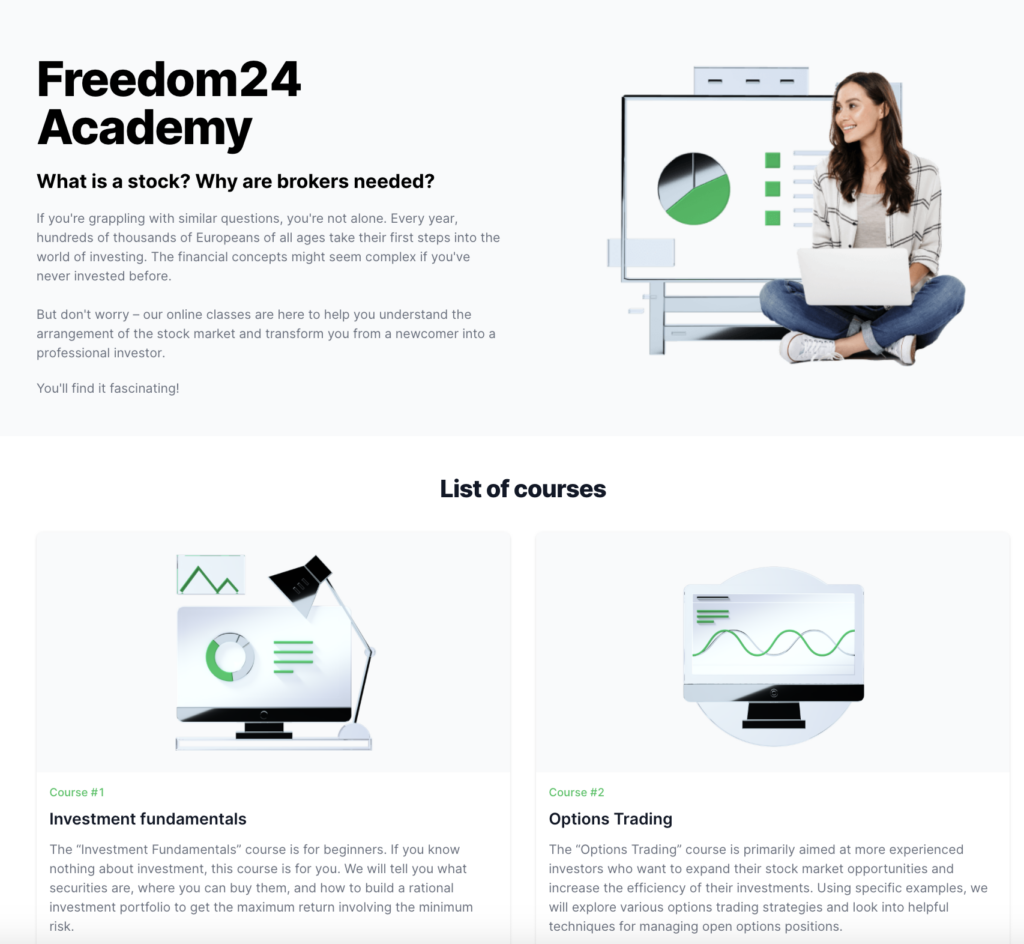

Research and Education

Freedom24 equips investors with extensive research and educational resources, promoting informed decision-making.

While Freedom24 provides a wide range of educational materials to support traders, there is room for further expansion and improvement compared to leading industry platforms. The platform’s learning center covers various topics through video tutorials, webinars, and written guides, catering to fundamental trading education.

Customer Support

Freedom24 stands as your reliable trading ally, offering robust customer support at every step of your journey.

Clients can access assistance through various channels, including email, telephone, and dedicated personal managers, ensuring prompt and knowledgeable responses to inquiries or concerns. The support team, which includes Spanish-speaking professionals, operates diligently from 09:00 to 21:00 (Mon – Fri), aligning with trading hours to provide timely assistance. Moreover, Freedom24’s commitment to same-day email responses enhances communication efficiency, resolving inquiries promptly. The availability of personal account managers further enriches the trading experience, offering tailored guidance and support, reinforcing Freedom24’s commitment to excellent customer service.

Account Opening

Freedom24 ensures a seamless account opening process, prioritizing ease and efficiency for users.

Registration: Begin by filling out a concise registration form on the Freedom24 website, providing basic information such as your name, email, and phone number to initiate the process.

Verification: Once registered, verify your email address and phone number to proceed with setting up your account.

Providing Additional Information: You’ll then be prompted to furnish additional details, including your date of birth, residential address, and trading experience, to tailor your trading experience according to your needs.

Document Upload: Complete the process by uploading specific identification documents to validate your identity and confirm your address, in compliance with regulatory requirements.

Freedom24’s user-friendly interface and straightforward steps ensure a swift and hassle-free account opening experience. With no minimum deposit requirement, users can embark on their trading journey without financial constraints.

Deposit and Withdrawals

Streamlined Transactions for Peace of Mind

Freedom24 prioritizes user convenience with its straightforward deposit and withdrawal processes, ensuring accessibility and efficiency.

Deposits: Users can fund their accounts through various methods, including credit/debit cards, bank transfers, ApplePay, and GooglePay. Notably, Freedom24 waives deposit fees for bank transfers, promoting cost-effectiveness. With a minimum deposit requirement of zero, traders of all investment capacities can participate without barriers.

Withdrawals: Freedom24 expedites withdrawal requests, typically processing them within 1-3 business days for prompt access to funds. A flat withdrawal fee of 7€ applies, regardless of the withdrawal amount.

Freedom24’s commitment to user-friendly transactions, coupled with transparent policies, underscores its dedication to providing a stress-free trading experience.

Final Thoughts on

Freedom24 garners praise from users due to its extensive selection of tradable assets, providing access to 15 prominent global stock exchanges. The platform’s intuitive interface accommodates investors of all levels, offering features tailored to both novice and experienced traders. Notable offerings include competitive interest rates on savings, expert market analysis, and educational materials to enrich the trading journey. Despite the absence of fractional shares and a fixed withdrawal fee, Freedom24’s strong security protocols, regulatory compliance, and diverse account options position it as an attractive choice for traders within the EU market.

To learn more about Freedom 24, you can visit their Wikipedia page for additional information and insights.

You want to discover Other Options? Check our Brokers suggestions

Capitacritique.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Capitacritique does not include information about every financial or credit product or service.