In an ever-changing market landscape, investors seek stability and consistent returns. Monthly dividend stocks offer just that – a steady stream of income that arrives every month, providing financial security and peace of mind. But with countless options available, choosing the right monthly dividend stocks can be daunting. Fear not! In this comprehensive guide, titled “7 Best Monthly Dividend Stocks To Buy Now,” we’ll unveil the top 7 monthly dividend stocks that savvy investors should consider adding to their portfolios.

Table of Contents

Realty Income Corporation (O):

Realty Income Corporation (NYSE: O) is a real estate investment trust (REIT) widely known as “The Monthly Dividend Company.” Here’s an in-depth look at what makes Realty Income a compelling investment:

Steady Income Stream: Realty Income has a remarkable track record of consistently paying monthly dividends for over 50 years. This consistent income stream appeals to income-seeking investors who rely on regular cash flow from their investments.

Diverse Portfolio: The company’s portfolio comprises over 6,500 commercial properties across diverse industries, including retail, industrial, and office spaces. This diversification helps mitigate risks associated with economic downturns and tenant vacancies.

High-Quality Tenants: Realty Income primarily leases its properties to well-known retail and commercial tenants, such as Walgreens, Dollar General, and FedEx. These tenants typically sign long-term lease agreements, providing stability and predictability to the company’s rental income.

Inflation Protection: Many of Realty Income’s lease agreements include built-in rent escalations or annual rent increases tied to inflation. This feature helps protect investors against the eroding effects of inflation over time.

Disciplined Capital Allocation: Realty Income’s management team follows a disciplined approach to capital allocation, focusing on acquiring properties with strong fundamentals and maintaining a conservative balance sheet. This approach has contributed to the company’s long-term success and shareholder value creation.

Investment Grade Credit Ratings: The company maintains investment-grade credit ratings from leading credit rating agencies, indicating its financial stability and creditworthiness. This allows Realty Income to access capital markets at favorable terms and conditions.

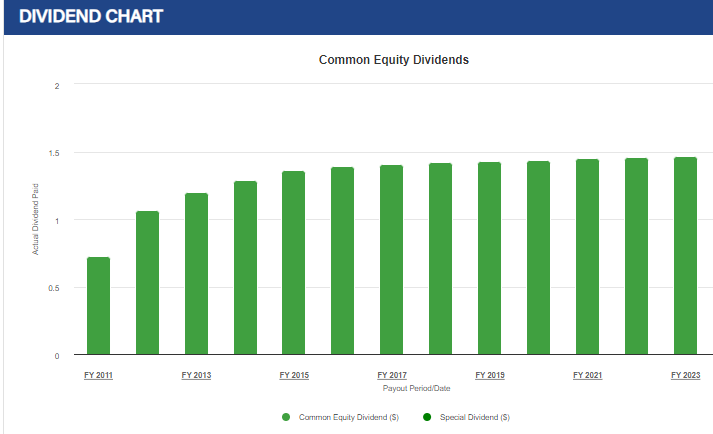

Track Record of Dividend Growth: Realty Income has a history of increasing its dividend payout to shareholders over time. This commitment to dividend growth reflects the company’s financial strength and management’s confidence in its ability to generate sustainable cash flow.

In an ever-changing market landscape, investors seek stability and consistent returns. Monthly dividend stocks offer just that – a steady stream of income that arrives every month, providing financial security and peace of mind. But with countless options available, choosing the right monthly dividend stocks can be daunting. Fear not! In this comprehensive guide, titled “7 Best Monthly Dividend Stocks To Buy Now,” we’ll unveil the top 7 monthly dividend stocks that savvy investors should consider adding to their portfolios.

Among these top picks is Realty Income Corporation (O). With its proven track record of delivering monthly dividends and its focus on high-quality commercial real estate assets, Realty Income Corporation stands out as a compelling choice for income-oriented investors. Overall, Realty Income Corporation offers investors a compelling opportunity to generate consistent income and participate in the potential long-term appreciation of high-quality commercial real estate assets.

Main Street Capital Corporation (MAIN):

In these 7 Best Monthly Dividend Stocks to Buy Now, we couldnt miss the Main Street Capital Corporation (MAIN) is a business development company that primarily invests in lower middle-market companies. It provides debt and equity financing to companies across various industries, including consumer discretionary, industrials, healthcare, and information technology.

Here are some key points about Main Street Capital Corporation (MAIN):

Business Model: Main Street Capital Corporation operates as a closed-end, non-diversified management investment company. It focuses on providing customized debt and equity financing solutions to lower middle-market companies.

Investment Strategy: The company typically invests in debt and equity securities of privately owned companies. It aims to generate both current income and capital appreciation from its investments.

Portfolio Diversification: Main Street Capital maintains a diversified portfolio of investments across different sectors and industries. This diversification helps mitigate risk and enhances the stability of its investment portfolio.

Dividend Payments: One attractive feature of Main Street Capital Corporation for investors is its consistent dividend payments. The company distributes dividends on a monthly basis, making it an attractive option for income-oriented investors seeking regular cash flow.

Financial Performance: Investors often analyze Main Street Capital’s financial performance, including its revenue, net income, and earnings per share, to assess its overall profitability and growth potential.

Risk Factors: Like any investment, Main Street Capital Corporation carries certain risks, including credit risk, interest rate risk, and market risk. Investors should carefully evaluate these risks before investing in the company’s securities.

Stag Industrial (STAG):

Stag Industrial (STAG) is a real estate investment trust (REIT) that focuses on the acquisition, ownership, and management of single-tenant industrial properties throughout the United States. Here are some key points about Stag Industrial, one of the 7 Best Monthly Dividend Stocks to Buy Now

Investment Focus: Stag Industrial primarily invests in single-tenant industrial properties, including warehouse, distribution, and manufacturing facilities. These properties are typically leased to tenants operating in various industries, such as logistics, e-commerce, manufacturing, and automotive.

Geographic Diversification: Stag Industrial’s portfolio is geographically diversified across major metropolitan areas and key logistics hubs in the United States. This diversification helps reduce concentration risk and provides exposure to different regional economies and market dynamics.

Tenant Base: The company’s tenant base consists of a diverse mix of creditworthy tenants, including national and regional companies, as well as government agencies. Stag Industrial focuses on leasing properties to tenants with long-term lease agreements, which provide stable and predictable cash flow.

Growth Strategy: Stag Industrial pursues a growth-oriented strategy focused on acquiring high-quality industrial properties with attractive risk-adjusted returns. The company seeks to enhance shareholder value through strategic acquisitions, proactive asset management, and disciplined capital allocation.

Dividend Policy: Stag Industrial is known for its dividend-paying track record. As a REIT, the company is required to distribute at least 90% of its taxable income to shareholders in the form of dividends. Stag Industrial’s consistent dividend payments make it an attractive investment option for income-oriented investors.

Financial Performance: Investors often evaluate Stag Industrial’s financial performance, including key metrics such as funds from operations (FFO), net operating income (NOI), and occupancy rates, to assess the company’s profitability and operational efficiency.

Risk Factors: Like any real estate investment, Stag Industrial’s business is subject to various risks, including market volatility, interest rate fluctuations, tenant defaults, and economic downturns. Investors should carefully consider these risks before investing in the company’s securities.

Shaw Communications Inc. (SJR):

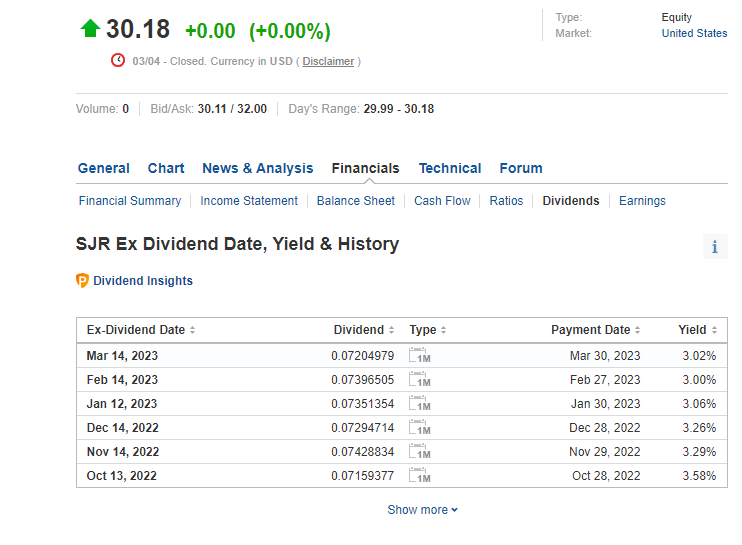

Shaw Communications Inc. (SJR) is a leading Canadian telecommunications company that provides a wide range of services, including internet, television, home phone, and mobile services. Here are some key points about Shaw Communications, one of the 7 Best Monthly Dividend Stocks to Buy Now:

Telecommunications Services: Shaw Communications offers various telecommunications services to residential and business customers across Canada. These services include high-speed internet, digital television, home phone, and mobile phone plans.

Market Presence: Shaw Communications has a significant presence in the Canadian telecommunications market, competing with other major providers such as Telus, Rogers Communications, and Bell Canada. The company serves millions of customers nationwide and operates in both urban and rural areas.

Infrastructure: Shaw Communications has invested in building and maintaining a robust telecommunications infrastructure, including fiber-optic networks, cable systems, and wireless infrastructure. This infrastructure enables the delivery of high-quality services to customers and supports the company’s growth initiatives.

Wireless Business: In addition to its traditional wireline services, Shaw Communications entered the wireless market with the acquisition of Freedom Mobile (formerly Wind Mobile) in 2016. This acquisition expanded Shaw’s offerings to include mobile phone plans and positioned the company as a more comprehensive telecommunications provider.

Content Offerings: Shaw Communications provides a diverse range of content offerings to its customers, including digital television channels, on-demand programming, streaming services, and premium content packages. The company partners with content providers to offer a wide selection of entertainment options to its subscribers.

Financial Performance: Investors often evaluate Shaw Communications’ financial performance, including revenue growth, profitability, and subscriber metrics, to assess the company’s overall health and operational efficiency. Key financial metrics may include revenue per user (ARPU), subscriber churn rate, and capital expenditures.

Regulatory Environment: Like other telecommunications companies, Shaw Communications operates in a regulated environment governed by federal and provincial regulations. Changes in regulations, licensing requirements, or government policies can impact the company’s operations and financial performance.

Competitive Landscape: Shaw Communications faces competition from other telecommunications providers, as well as emerging technologies and alternative service providers. The company must continuously innovate and differentiate its offerings to remain competitive in the dynamic telecommunications market.

Pembina Pipeline Corporation (PBA):

Pembina Pipeline Corporation (PBA) is a leading transportation and midstream service provider based in Canada. Here are some key points about Pembina Pipeline:

Transportation Infrastructure: Pembina Pipeline operates an extensive network of pipelines and transportation assets that facilitate the movement of energy products, including crude oil, natural gas, and natural gas liquids (NGLs). The company’s pipelines span across key producing regions in Canada and the United States, connecting supply sources to major markets and export terminals.

Midstream Services: In addition to its transportation assets, Pembina provides a range of midstream services, including storage, processing, fractionation, and terminal operations. These services support the gathering, processing, and marketing of energy products, serving producers, refiners, and other customers in the energy sector.

Integrated Value Chain: Pembina operates an integrated value chain that encompasses both upstream and downstream activities in the energy sector. This integrated model allows the company to capture value at multiple stages of the energy supply chain, from production and transportation to processing and distribution.

Diversified Portfolio: Pembina Pipeline has a diversified portfolio of assets across various energy commodities and geographic regions. This diversification helps mitigate risk and provides stability to the company’s revenue streams, even in challenging market conditions.

Strategic Partnerships: Pembina has established strategic partnerships with key stakeholders in the energy industry, including producers, shippers, and customers. These partnerships enable the company to collaborate on infrastructure development projects, optimize asset utilization, and enhance customer service offerings.

Environmental and Social Responsibility: Pembina is committed to operating in a socially and environmentally responsible manner. The company adheres to rigorous safety and environmental standards, invests in emission reduction initiatives, and engages with stakeholders to address concerns and promote sustainable practices.

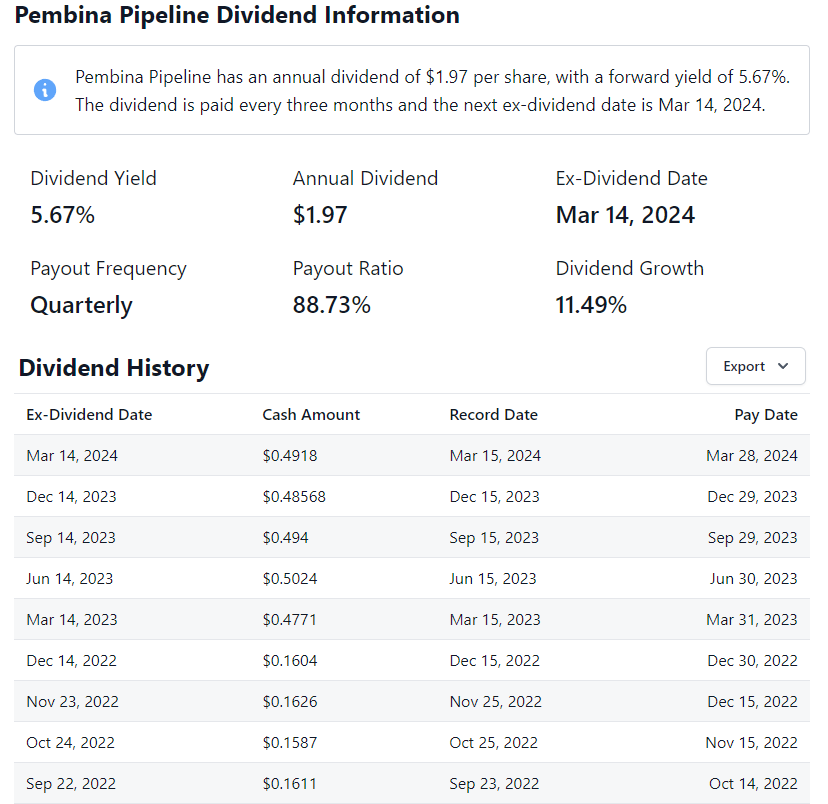

Financial Performance: Investors often assess Pembina Pipeline’s financial performance, including revenue growth, cash flow generation, and profitability metrics. Key financial indicators may include earnings before interest, taxes, depreciation, and amortization (EBITDA), debt levels, and dividend payments.

Regulatory Environment: Pembina Pipeline operates within a regulated environment governed by federal, provincial, and state regulations. Changes in regulatory requirements, permitting processes, or government policies can impact the company’s operations and capital investment decisions.

AGNC Investment Corp. (AGNC):

AGNC Investment Corp. (AGNC) is a real estate investment trust (REIT) that primarily invests in agency mortgage-backed securities (MBS). Here’s an overview of AGNC Investment Corp.:

Investment Strategy: AGNC primarily focuses on investing in agency MBS, which are securities backed by mortgages guaranteed by government-sponsored enterprises such as Fannie Mae and Freddie Mac. These securities are considered low-risk due to the implicit backing of the U.S. government, making them attractive investments for income-oriented investors.

Interest Rate Sensitivity: As a mortgage REIT, AGNC’s investment portfolio is highly sensitive to changes in interest rates. When interest rates rise, the value of MBS tends to decline, leading to potential capital losses for AGNC. Conversely, falling interest rates can increase the value of MBS, potentially boosting AGNC’s book value and net income.

Leverage: AGNC typically utilizes leverage to enhance returns on its investment portfolio. By borrowing funds at short-term interest rates and investing in higher-yielding MBS, AGNC aims to generate a spread income, which contributes to its dividend payments to shareholders. However, leverage also amplifies the risks associated with interest rate fluctuations and credit risk.

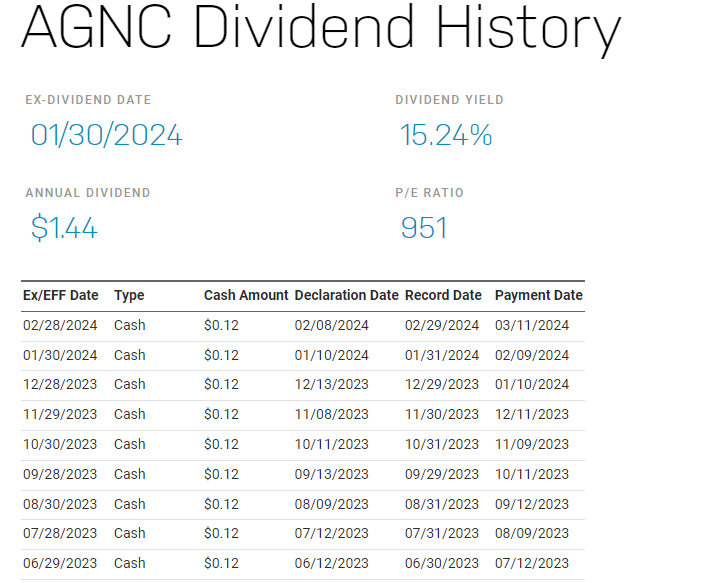

Dividend Policy: AGNC is known for its attractive dividend yield, which is a key attraction for income-seeking investors. The company distributes a significant portion of its earnings to shareholders in the form of dividends, often on a monthly basis. AGNC’s dividend yield is influenced by its net interest spread, earnings stability, and dividend sustainability.

Risk Management: AGNC employs various risk management strategies to mitigate interest rate risk, including hedging through interest rate swaps, options, and other derivatives. These strategies aim to protect the company’s net asset value (NAV) and cash flow from adverse movements in interest rates and market conditions.

Regulatory Environment: As a REIT, AGNC is subject to regulatory requirements governing the operation and taxation of REITs. Compliance with these regulations, including maintaining certain distribution requirements and avoiding prohibited activities, is essential for AGNC to maintain its favorable tax status as a REIT.

Market Performance: Investors closely monitor AGNC’s financial performance, including its net interest income, net asset value, leverage ratio, and dividend sustainability. Changes in interest rates, mortgage prepayment rates, and credit spreads can impact AGNC’s earnings and share price performance.

Industry Outlook: AGNC’s performance is influenced by macroeconomic factors, monetary policy decisions, and trends in the housing and mortgage markets. Economic indicators, such as employment data, inflation rates, and housing affordability, can provide insights into AGNC’s future prospects and investment opportunities.

LTC Properties Inc. (LTC):

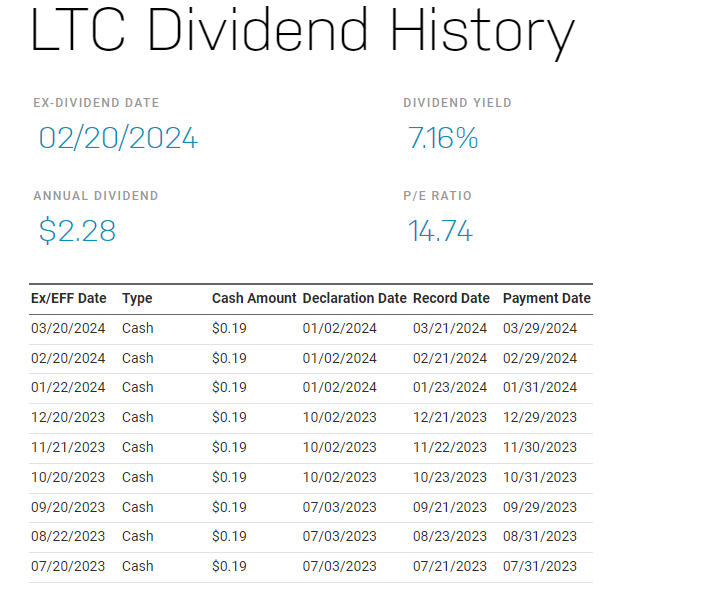

LTC Properties Inc. (LTC) is a real estate investment trust (REIT) specializing in senior housing and healthcare properties. Here’s an overview of LTC Properties:

Investment Focus: LTC Properties primarily invests in senior housing and healthcare properties, including assisted living facilities, skilled nursing facilities, independent living communities, and memory care facilities. These properties cater to the needs of elderly residents requiring various levels of care and support.

Portfolio Diversification: LTC Properties maintains a diversified portfolio of properties across different geographic regions in the United States. Diversification helps mitigate risks associated with localized economic conditions, regulatory changes, and demographic trends, providing stability and resilience to LTC’s cash flows and property values.

Tenant Relationships: LTC Properties leases its properties to established operators and tenants in the senior housing and healthcare industry. These operators typically have extensive experience and track records in managing senior living facilities, ensuring the quality of care and services provided to residents.

Lease Structures: LTC Properties typically enters into long-term triple-net leases with its tenants, wherein the tenants are responsible for property operating expenses, including property taxes, insurance, and maintenance. Triple-net leases provide predictable rental income streams and reduce LTC’s exposure to operating risks.

Demographic Trends: LTC Properties benefits from favorable demographic trends, including the aging population in the United States. As the baby boomer generation continues to age, the demand for senior housing and healthcare services is expected to increase, driving demand for LTC’s properties.

Regulatory Environment: The senior housing and healthcare industry is subject to extensive regulatory oversight at the federal, state, and local levels. LTC Properties monitors regulatory developments closely and works with its tenants to ensure compliance with applicable laws and regulations governing healthcare facilities.

Financial Performance: Investors evaluate LTC Properties based on key financial metrics, including occupancy rates, rental revenues, funds from operations (FFO), and dividend sustainability. Stable occupancy rates and consistent rental income are indicative of the underlying strength of LTC’s portfolio and tenant relationships.

Industry Outlook: LTC Properties’ performance is influenced by broader trends in the healthcare industry, healthcare policy changes, reimbursement rates, and consumer preferences for senior living options. Anticipated shifts in healthcare delivery models and advancements in technology may also impact LTC’s long-term growth prospects.

In summary, LTC Properties Inc. (LTC) presents a robust investment opportunity within the senior housing and healthcare real estate sector. With a diversified portfolio, stable tenant relationships, and favorable demographic trends, LTC offers investors exposure to a resilient market poised for long-term growth. While regulatory considerations and industry dynamics require careful monitoring, LTC’s triple-net lease structures and experienced management team provide a solid foundation for income generation and potential capital appreciation.

For more investment insights and opportunities, be sure to explore our comprehensive guide on the “11 Best Investments in 2024,” where you’ll find a curated selection of investment options tailored to various risk profiles and financial goals. Additionally, don’t forget to check out our list of “10 Best Low-Risk Investments” for investors seeking stability and income generation in uncertain market conditions.

Conclusion

“In conclusion, the 7 Best Monthly Dividend Stocks to Buy Now offer investors a compelling opportunity to generate consistent income while potentially benefiting from long-term capital appreciation. From Realty Income Corporation’s steady stream of income to Main Street Capital Corporation’s diverse investment portfolio, each stock brings unique advantages to the table. Additionally, Stag Industrial’s focus on single-tenant industrial properties and Shaw Communications Inc.’s leadership in the Canadian telecommunications sector further diversify investment opportunities. Moreover, Pembina Pipeline Corporation’s strong position in the energy infrastructure market, AGNC Investment Corp.’s focus on residential mortgage-backed securities, and LTC Properties Inc.’s exposure to the senior housing and healthcare real estate sector add depth to a well-rounded investment portfolio. By considering these top-performing monthly dividend stocks, investors can build a resilient portfolio that offers both income stability and growth potential.