Despite initial concerns, last year proved to be a strong period for stocks, witnessing significant market growth despite challenges such as surging interest rates and looming recession risks. The outlook for this year remains uncertain, with contrasting forecasts suggesting a potential recession in the U.S. or a gradual economic slowdown, termed as a ‘soft landing.’ Amidst this ambiguity, there are still promising investment opportunities, particularly for long-term investors.

Which investments hold promise for the current year?

The following list begins with safer options before delving into potentially higher-yielding but more volatile choices, offering a balanced approach to navigate through what appears to be a challenging market landscape

Chek the best investments below

Table of Contents

Why invest?

Investing presents an opportunity to diversify your income streams, secure your retirement, or overcome financial challenges. Primarily, it serves as a means to expand your wealth, enabling you to achieve financial objectives and enhance your purchasing power over time. Whether you’ve recently obtained a windfall, sold property, or acquired additional funds, allowing your money to work for you is a prudent decision.

However, while investing has the potential to generate wealth, it’s essential to consider the associated risks and strike a balance between potential gains and vulnerabilities. It’s crucial to be financially prepared by managing debt responsibly, maintaining an emergency fund, and being resilient during market fluctuations without needing immediate access to your invested capital.

The investment landscape offers diverse options, ranging from low-risk instruments like CDs and money market accounts to moderate-risk choices such as corporate bonds and higher-risk ventures like stock index funds. This variety allows you to tailor your investments to your risk tolerance and financial goals, facilitating the creation of a well-rounded and diversified portfolio for enhanced stability and security.

1. High-yield savings accounts

Summary: A high-yield online savings account allows you to earn interest on your cash balance, offering accessibility similar to traditional savings accounts at physical banks.

Ideal Candidates: These accounts are suitable for individuals needing quick access to cash and risk-averse investors seeking security for their funds.

Risk Factors: Many banks offering high-yield savings accounts are FDIC-insured, ensuring deposit safety within federal insurance limits. However, like CDs, there’s a risk of losing purchasing power over time if inflation outpaces interest rates.

Benefits: Online banks typically offer higher interest rates due to lower overhead costs compared to traditional banks. Additionally, transferring funds to your primary bank or accessing them via ATMs is often convenient. Moreover, interest rates may exceed inflation rates for much of the year, potentially increasing purchasing power.

Availability: Explore Bankrate’s selection of top high-yield savings accounts for competitive rates. Alternatively, consider local banks or credit unions, though rates may not be as favorable.

2. Long-term certificates of deposit

Summary: Certificates of deposit (CDs) are bank-issued financial products that typically offer higher interest rates than savings accounts, making them attractive for investors seeking steady returns.

Ideal Candidates: Retirees with a long-term investment horizon and risk-averse individuals who can afford to lock up their funds may benefit from CDs. These investments suit those who prioritize safety and are willing to forgo immediate access to cash for higher yields.

Risk Considerations: While CDs are generally safe, they carry reinvestment risk, particularly when interest rates fluctuate. Inflation and taxes can also impact the purchasing power of CD investments.

Potential Gains: CDs provide regular interest payments and return the principal amount upon maturity, offering a predictable income stream. Shopping around for competitive CD rates online is advisable to maximize returns.

Availability: While traditional banks and credit unions offer CDs, superior rates may be found through online institutions rather than local options.

3. Long-term corporate bond funds

Summary: Corporate bond funds are investment vehicles comprised of bonds issued by various corporations, providing investors with exposure to a diversified portfolio of corporate debt securities.

Ideal Candidates: Corporate bond funds are suitable for investors seeking consistent cash flow, such as retirees, or those aiming to mitigate portfolio risk while pursuing returns. Long-term corporate bond funds are particularly appealing to risk-averse individuals desiring higher yields than government bond funds.

Risk Considerations: Unlike FDIC-insured options, corporate bond funds carry inherent risks, including the possibility of credit rating downgrades or defaults by bond-issuing companies. However, diversification within bond funds helps mitigate individual bond risks.

Potential Gains: Investment-grade long-term bond funds typically offer superior returns compared to government and municipal bond funds, albeit with increased risk. Higher rewards are attainable, but investors should be mindful of accompanying risks.

Availability: Corporate bond funds can be traded through brokers that facilitate ETF or mutual fund transactions. While ETF trades often incur no commission fees, purchasing mutual funds may require commissions or minimum investment thresholds with certain brokers.

4. Dividend stock funds

Overview: Dividends represent profits distributed by a company to its shareholders, typically on a quarterly basis. Dividend stocks are equities that offer cash payouts, distinguishing them from stocks that do not. Conversely, dividend funds consolidate dividend-paying stocks into a single investment vehicle for simplified acquisition.

Ideal Candidates: Purchasing individual dividend stocks is more suitable for experienced investors, but diversification can mitigate risk. Dividend stock funds cater to various investor profiles, particularly those seeking income generation. Investors with a long-term investment horizon and income needs may find dividend funds particularly appealing.

Risks: While dividend stocks are generally considered safer than growth or non-dividend-paying stocks, inherent risks remain. Investors should prioritize companies with a consistent history of dividend growth, avoiding those with excessively high yields, which could indicate underlying issues. However, even reputable companies may face crises, potentially impacting dividend payouts.

Diversified dividend stock funds mitigate individual company risks by spreading investments across multiple assets, bolstering portfolio resilience.

Rewards: Dividend stocks offer a dual benefit of potential long-term capital appreciation and immediate cash returns. Investing in dividend-paying equities can enhance portfolio stability while providing regular income.

Availability: Dividend stock funds are accessible through ETFs or mutual funds offered by various brokers. ETFs often feature no minimum investment requirements and are commission-free, whereas mutual funds may impose minimum purchase thresholds and brokerage commissions depending on the platform.

5. Value stock funds

Overview: Value stock funds focus on investing in stocks that are priced lower relative to others in the market, often considered bargain-priced assets.

Ideal Candidates: During periods of high stock valuations, investors seeking alternative investment opportunities may turn to value stock funds. These funds are suitable for individuals comfortable with the inherent volatility of stock investing and possess a longer-term investment horizon of at least three to five years.

Risks: While value stock funds generally offer a degree of safety due to their discounted pricing, they remain subject to stock market fluctuations and lack government insurance protection. Consequently, they may experience greater volatility compared to safer investments like short-term bonds.

Rewards: Value stocks typically perform well in environments of rising interest rates, as they become more attractive relative to growth stocks. Additionally, many value stock funds offer dividend payments, further enhancing their appeal to investors.

Availability: Value stock funds are typically available in two primary forms: ETFs or mutual funds. ETFs are commonly accessible commission-free and without minimum investment requirements at major online brokers. Conversely, mutual funds may necessitate a minimum investment and could incur brokerage commissions, although some brokers offer a wide selection of mutual funds without transaction fees.

6. Small-cap stock funds

Overview: Small-cap funds specialize in investing in stocks of relatively small companies, known as small caps. These companies often exhibit robust growth potential, with many eventually growing into market leaders. By pooling together dozens or even hundreds of small-cap stocks, a small-cap fund provides investors with a convenient and diversified investment option.

Ideal Candidates: Small-cap funds are suitable for investors seeking attractive long-term returns and possessing the ability to remain invested for extended periods, typically three to five years. Given their composition of stocks, these funds are subject to higher levels of volatility compared to more conservative investments.

Risks: Small-cap stocks inherently carry more risk than their large-cap counterparts. These smaller companies are less established, possess fewer financial resources, and exhibit greater volatility. However, the diversification offered by a small-cap fund helps mitigate some of these risks by spreading investments across a range of small-cap stocks.

Rewards: Small-cap stock funds have the potential to deliver substantial returns over time, with top-performing small-cap ETFs often achieving double-digit annual returns. With interest rates likely peaking, small-cap stocks, including those in small-cap funds, may be well-positioned for strong performance in the coming year.

Availability: Small-cap funds are accessible as both ETFs and mutual funds and can be purchased through brokers offering these investment vehicles. Typically, ETFs are available commission-free, while mutual funds may incur transaction fees.

7. REIT index funds

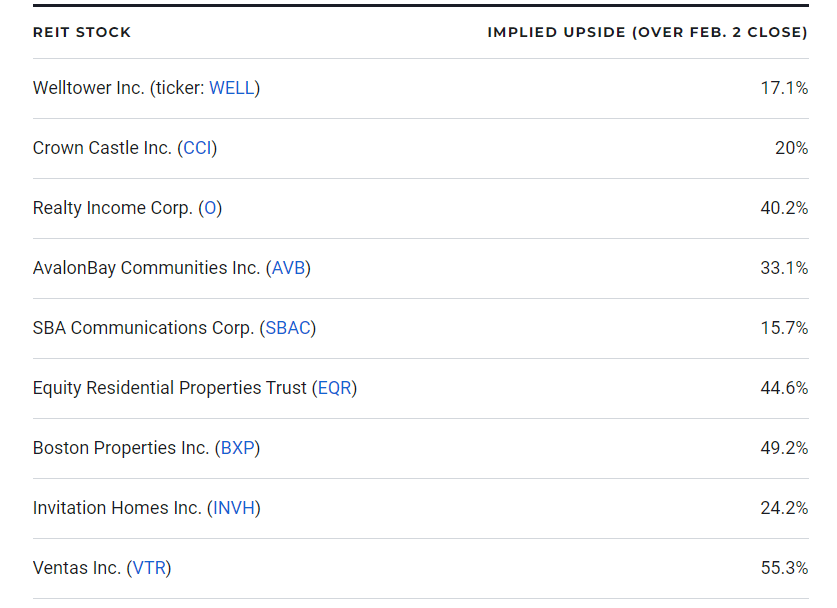

Overview: Real estate investment trusts (REITs) offer an appealing avenue for investing in real estate. REITs distribute dividends to investors in exchange for tax advantages at the corporate level, with REIT index funds passing these dividends along to shareholders. Publicly traded REIT funds encompass a diverse range of stocks across various sub-sectors such as lodging, apartments, and offices, providing investors with diversified exposure to real estate without the hassles of property management. Despite challenging years amid rising rates, REITs may show promise in 2024.

Ideal Candidates: REIT index funds, known for their substantial dividend payouts, appeal to income-focused investors like retirees. However, they also offer potential for capital appreciation over time. Given the volatility in publicly traded REIT prices, investors must adopt a long-term perspective and be prepared for market fluctuations.

Risks: Investing in a REIT index fund mitigates the risks associated with owning individual REITs by providing diversification across multiple holdings. Nevertheless, fund prices may fluctuate, particularly with rising interest rates. Caution is warranted with non-publicly traded REITs or REIT funds.

Rewards: Investors stand to benefit from a dual income stream through growing dividends and potential capital appreciation. A well-performing REIT fund could yield annual returns of 10 to 12 percent over time, with a significant portion derived from cash dividends.

Availability: REIT funds are accessible through brokers offering ETF or mutual fund trading capabilities. ETFs often come commission-free, whereas mutual funds may entail commissions and minimum purchase requirements.

8. S&P 500 index funds

Overview: An S&P 500 index fund mirrors the performance of approximately five hundred of the largest American companies, encompassing some of the most successful entities globally. Notable members include Amazon and Berkshire Hathaway, among others.

Ideal Candidates: For those seeking higher returns compared to traditional banking products or bonds, an S&P 500 index fund presents a compelling alternative, albeit with increased volatility. It serves as an excellent entry point for novice investors, offering broad and diversified exposure to the stock market. Additionally, it suits any stock investor seeking diversification and capable of maintaining a long-term investment horizon of at least three to five years.

Risks: While relatively less risky than individual stocks, an S&P 500 fund entails market exposure and therefore exhibits volatility. It lacks government insurance, hence fluctuations in value can lead to financial losses. Nonetheless, the index has historically performed well over time, rebounding strongly after the pandemic-induced decline in March 2020, despite a sluggish performance in 2022. Investors are advised to adhere to their long-term investment strategies.

Rewards: Similar to other funds, an S&P 500 index fund provides instant diversification by granting ownership in all constituent companies. Its inclusion of firms across various industries enhances resilience. Historically, the index has yielded around 10 percent annually, offering low expense ratios and ranking among the top index funds.

Where to get them: S&P 500 index funds are accessible through brokers permitting ETF or mutual fund trading. ETFs typically incur no additional charges, while mutual funds may levy commissions and stipulate minimum purchase requirements.

9. Nasdaq-100 index funds

Overview: Opting for an index fund tracking the Nasdaq-100 is an excellent strategy for investors seeking exposure to leading tech companies without the need to cherry-pick winners or analyze individual firms.

The fund comprises the Nasdaq’s top 100 companies, representing some of the most successful and stable entities in the market. Notable constituents include Apple and Alphabet, which command significant portions of the overall index, alongside prominent member Microsoft.

Ideal Candidates: Nasdaq-100 index funds suit stock investors pursuing growth opportunities and prepared to withstand considerable volatility. Commitment to a three to five-year holding period is advisable, and employing dollar-cost averaging can mitigate risks associated with market fluctuations.

Risks: While housing some of the tech sector’s strongest players, the Nasdaq-100’s constituent companies often carry lofty valuations, rendering them susceptible to swift declines in adverse market conditions. Conversely, they may experience rapid ascents during economic rebounds.

Rewards: Investing in a Nasdaq-100 index fund provides immediate diversification, shielding your portfolio from the pitfalls of individual company failures. The top Nasdaq index funds boast low expense ratios, offering cost-effective exposure to all index components.

Where to get them: Nasdaq-100 index funds are accessible as ETFs and mutual funds. Many brokers permit commission-free ETF trading, while mutual funds may entail commission charges and minimum purchase requirements.

10. Rental housing

Overview: Investing in rental housing presents an enticing opportunity for those willing to undertake property management responsibilities. To embark on this path, you’ll need to carefully select properties, arrange financing, handle maintenance, and manage tenants. Making prudent acquisitions can yield substantial returns, particularly given recent cooling trends in housing prices and the stabilization of interest rates in 2023.

Ideal Candidates: Rental housing investment suits long-term investors seeking to oversee their own properties and generate consistent rental income.

Risks: Unlike the ease of trading stocks with a simple click, real estate transactions require more hands-on involvement. Additionally, landlords may encounter unexpected challenges such as emergency maintenance issues.

Rewards: With interest rates reaching cyclical highs last year, financing a new property purchase in 2024 amid declining rates could be advantageous, although economic volatility may pose operational challenges. Over time, as you gradually pay down debt and increase rental income, rental properties can provide robust cash flow, particularly in retirement.

Where to get them: Securing rental properties typically involves collaborating with a real estate broker or cultivating a network to access potential deals before they reach the open market.

11. peer to peer lending

Peer-to-peer lending, also known as P2P lending or social lending, has emerged as a disruptive force in the financial industry. It leverages online platforms to connect individuals seeking loans with investors looking to lend money for returns. This direct lending model bypasses traditional banks and financial institutions, offering benefits to both borrowers and investors.

For borrowers, peer-to-peer lending provides an alternative source of financing with potentially lower interest rates and more flexible terms compared to traditional loans. Borrowers can apply for various types of loans, such as personal loans, business loans, student loans, and debt consolidation loans, through P2P platforms. The online application process is typically fast and convenient, with quick approval and funding decisions.

On the other hand, peer-to-peer lending presents an attractive investment opportunity for individuals seeking higher returns than traditional savings accounts or certificates of deposit (CDs). Investors can diversify their investment portfolio by funding multiple loans across different risk profiles and loan terms. P2P platforms usually offer tools and data to help investors evaluate loan opportunities and manage their investment portfolios effectively.

However, peer-to-peer lending carries inherent risks that investors should consider. The primary risk is the potential for borrower default or late payments, which could lead to a loss of principal and lower returns. While P2P platforms may perform credit checks and assess borrowers’ creditworthiness, there is still a risk of loan defaults, especially during economic downturns or adverse market conditions.

Additionally, peer-to-peer lending is subject to regulatory oversight, but the level of regulation varies by country and jurisdiction. Investors should carefully review the regulations governing P2P lending in their region and understand the platform’s policies for loan origination, underwriting, and collections.

Despite these risks, peer-to-peer lending continues to grow in popularity as both borrowers and investors seek alternatives to traditional banking and investment options. With careful due diligence and risk management, peer-to-peer lending can be a viable way to access credit or generate investment income in today’s financial landscape.

What to consider

As you contemplate your investment choices, several factors should be taken into consideration, including your risk tolerance, time horizon, investment knowledge, financial circumstances, and the amount you can allocate for investment.

For those aiming to build wealth, there are options ranging from low-risk investments offering modest returns to higher-risk ones promising potentially greater returns. Typically, there exists a trade-off between risk and return in investing. Alternatively, a balanced approach can be adopted, ensuring a portion of investments remains in secure avenues while allowing for opportunities for long-term growth.

The best investment strategies for 2024 offer a blend of risk and return, catering to various risk appetites and investment objectives.

Risk Tolerance: Risk tolerance refers to your ability to withstand fluctuations in the value of your investments. Are you inclined to take significant risks for the possibility of higher returns, or do you prefer a more conservative approach? This can be influenced by both psychological factors and your financial situation.

Conservative investors, including those nearing retirement, might opt for a higher allocation to low-risk investments. Such choices are also suitable for individuals with short- to intermediate-term savings goals. Investments in FDIC-protected accounts like CDs provide stability and security even during market volatility.

On the other hand, investors with a longer investment horizon and a higher risk tolerance may favor more aggressive portfolios. Diversification is crucial to mitigate risk. A longer time frame allows for the absorption of market fluctuations, potentially leading to higher returns from riskier assets like stocks.

Time Horizon: Your time horizon refers to the period over which you intend to hold your investments. It determines the suitability of different investment vehicles.

Shorter time horizons necessitate investments with liquidity and stability, such as savings accounts, CDs, or bonds. These assets are less volatile and provide predictable returns.

Conversely, longer time horizons afford the opportunity to weather market volatility and capitalize on the potential growth of riskier investments like stocks. Investing in equities or equity funds becomes feasible when holding periods extend to three to five years or more.

Alignment with your time horizon is crucial to avoid exposure to undue risk or illiquidity.

Investment Knowledge: Your level of investment knowledge shapes your investment decisions. While some products like savings accounts require minimal understanding, others like stocks and bonds demand more comprehensive knowledge.

Investing in complex assets necessitates a thorough understanding of the underlying factors. For instance, investing in individual stocks requires extensive research into company fundamentals, industry dynamics, and market trends.

However, there are avenues to participate in the market without extensive expertise, such as index funds. These funds offer exposure to a diversified portfolio of stocks, mitigating the risk associated with individual securities.

It’s essential to assess your investment knowledge and choose products that align with your understanding and expertise.

Investment Capacity: The amount you can invest influences the types of investments worth considering. Larger investment amounts may warrant exploration of higher-risk, higher-return opportunities.

With substantial capital, dedicating time and resources to research specific stocks or industries becomes feasible. The potential rewards justify the investment of time and effort, particularly when compared to bank products like CDs.

Conversely, smaller investment amounts may not justify the same level of research. In such cases, ETFs or mutual funds offer accessible alternatives that require less intensive management. These options are suitable for incremental investments and are commonly utilized in retirement accounts like 401(k)s.

Recap of the 10 best investments in 2024

- High-yield savings accounts

- Long-term certificates of deposit

- Long-term corporate bond funds

- Dividend stock funds

- Value stock funds

- Small-cap stock funds

- REIT funds

- S&P 500 index funds

- Nasdaq-100 index funds

- Rental housing

- Peer to Peer Lending

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.